Business Lending Statistics 2019: How Hard Is it to Get Approved?

Across nearly all industries, business owners are well-aware of how difficult it can be to get a business loan. Fortunately, the odds have increasingly been shifting in favor of the small business loan borrower – in part thanks to financial technology. Here, we’ll take a dive into the data that demonstrates the real challenges business owner face when applying for additional funding.

Getting a business loan in 2019

It’s no secret that small business owners face difficult odds when it comes to obtaining financing – particularly new business owners and startups. The hard time that small business owners have in getting approved for loans, regardless of what the additional money is meant for, has a real impact on their chances of survival (more on that below).

What’s also important to point out is that there are differences in the business loan approval rates between traditional banks (both big and small) and alternative lenders. Whether it’s through banks or online lenders, there remain obstacles that stand in the way of business owners (new or experienced) getting small business loan approvals. With all that said, even with recent advancements made in financial technology, small business lending statistics still highlight just how hard it is to get a business loan.

How hard is it to get a business loan?

If you’ve ever wondered “how hard is it to get a business loan?”, you’re not alone. The answer to that question can be interpreted in several ways.

Business loan statistics regarding approval rates vary depending on many factors, including the path by which business owners seek to obtain funding. Let’s take a quick glance at the small business loan rejection rates according to where the business applied for funding:

|

Type of Loan Provider |

*Approval Rates |

|

Big banks |

27.5% |

|

Small banks |

49.8% |

|

Alternative lenders (including online) |

57.2% |

*Statistics are according to the 2019 Biz2Credit Small Business Lending Index™.

Another angle that can be taken in order to answer “how hard is it to get a business loan” is according to the type of loan the business owner is seeking to obtain. Let’s look at the loan approval rates by loan type:

|

Type of Loan |

*Approval Rates |

|

Auto/Equipment loan |

82% |

|

Merchant cash advance |

79% |

|

Line of credit |

69% |

|

SBA loan |

54% |

*Statistics are according to Fed Small Business’s 2019 Small Business Credit Survey.

Some other interesting small business financing statistics that are worth noting include the differences in approval rates according to gender, ethnicity, geographic location, business age, and so on. Let’s have a look at small business loan approvals according to demographics:

|

Demographic Group |

*Approval Rates |

|

White-owned businesses |

49% |

|

Minority-owned businesses |

33% |

|

Male-owned businesses |

72% |

|

Female-owned businesses |

14% |

|

Existing businesses |

47% |

|

New businesses |

12% |

|

Urban businesses |

85% |

|

Rural businesses |

15% |

*Statistics are according to 2019 SBA Lending Statistics.

Small business lending statistics: ‘8’ stats you should know

The top 5 small business loan statistics that you should know:

- What percentage of small businesses seek additional financing?

- How many businesses receive the full amount they applied for?

- Where do most small business owners apply for loans?

- Which business lending sectors are performing best?

- How long do business owners wait to get funded after approval?

- Where should business owners search for the fastest loans?

- What do business owners say are their biggest obstacles to funding?

- What types of small business loans are most popular?

1. What percentage of small businesses seek additional financing?

According to a Federal Reserve survey, 43% of businesses applied for additional financing over the past 12 months.

2. How many businesses receive the full amount they applied for?

Of the 43% of businesses that have applied for funding in the past year, approximately half (20%) obtained the total amount of funding that they had applied for.

3. Where do most small business owners apply for loans?

Of the businesses that applied for a loan, line of credit, or cash advance:

- 49% applied through a large bank

- 44% applied through a small bank

- 32% applied through an online lender

- 9% applied through credit unions

- 5% applied through CDFIs (community development financial institutions)

4. Which business lending sectors are performing best?

The growth of application rates for large and small banks has remained somewhat steady over the past few years, shifting only a few percentage points up or down. Application rates for online lenders, on the other hand, have seen a dramatic upsurge with an increase of 13% over just two years!

5. How long do business owners wait to get funded after approval?

While the exact wait times vary greatly from one lending instution to the next, a general trend exists where banks (large and small) have longer wait times than online lenders. Small business stats support that claim, with 26% of Federal Reserve Survey respondents reporting that large banks had long wait times not just for the funding, but for the credit decision as well. Similarly, 20% of small banks were reported to have a long wait time.

6. Where should business owners search for the fastest loans?

According to small business loan statistics, respondents report the least amount of wait time challenges with online lenders compared to their bank competitors. That’s likely due to the efficiency of digital technology when it comes to quickly and accurately assessing businesses’ financial data.

7. Which businesses are most likely to face obstacles in obtaining funding?

The biggest hurdles that stand in the way of small businesses getting the financing that they apply for are (in order of impact) having a high credit risk (91% of firms), unprofitability (67%), being located in New England (66%), having less than 6 years experience (63%), and being based in an urban setting (56%).

8. What types of small business loans are most popular?

According to the 2019 Federal Reserve Small Business Credit Survey, 85% of businesses that were seeking funding in the past year have applied for a loan or line of credit (as opposed to credit cards, merchant cash advances, factoring, or trade credits).

Bonus statistic: 28% of businesses have applied for credit cards over the last 12 months, making them the second-most popular form of financing being applied for.

How to beat the odds and get your loan approved

With so many pitfalls that small business owners encounter along their journey toward obtaining funding, it’s high time that big changes be made to the business loan application process. That’s where Become steps in! They offer a data-based advantage when it comes to small business loan approval rates. Business owners can use the cutting-edge technology that Become has developed to defy the above statistics.

Unlike any other business lending institution or platform, Become uses advanced algorithms to analyze a business’s financial profile from top to bottom. How does that improve the rate of small business loan approvals? We’re glad you asked!

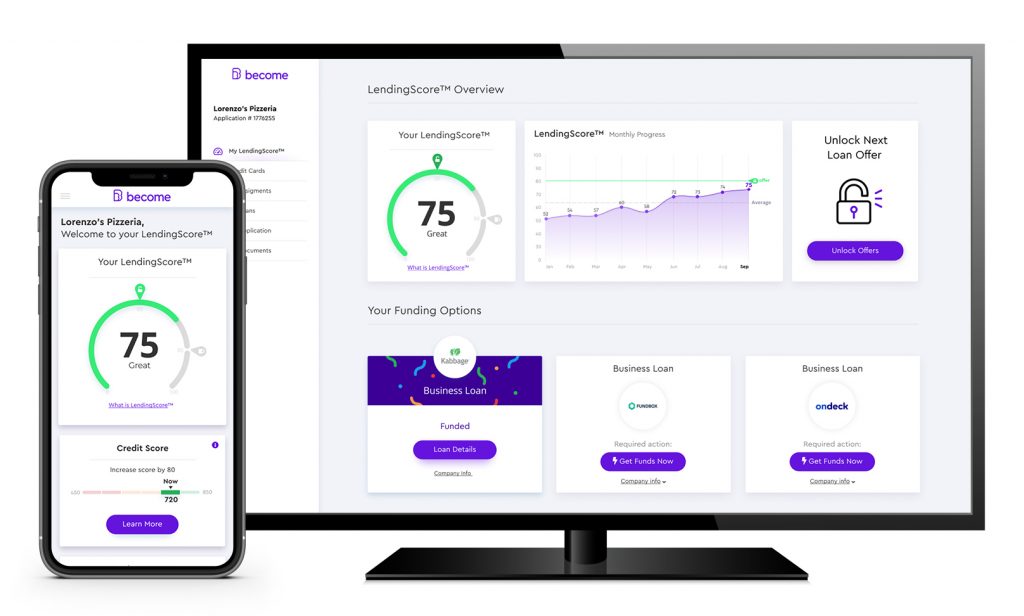

The results of a business’s analysis are presented to the business owner in the form of a tailored LendingScore™ dashboard, which offers them a level of transparency into their fundability that they simply won’t get anywhere else. First the business is attributed a LendingScore™, which is a score between 0 and 100 that represents the likelihood that a business has to receive funding. Naturally, the higher the score is, the better the odds are of funding. That’s only scratching the surface of what the LendingScore™ Dashboard is truly capable of doing for business owners.

Remember that point about transparency? The LendingScore™ Dashboard provides insights not only into which factors are impacting a business’s ability to get funded, but also goes the extra mile to tell business owners which factors are having a higher (or lower) impact. With LendingScore™, small business owners no longer have to guess and stress about what they need to do in order to get approved for financing. The entire business lending process has become faster, easier, and more likely to result in funding – thanks to LendingScore™ technology.

Statistically speaking…

We promised to take you deep into the data, and we’ve delivered. It’s now your turn to take the business loan application process into your own hands. Don’t let the small business financing statistics listed here stop you from making your business dreams real. With the help of Become, small business owners all across the country are doing just that!

Please feel free to share this article with your friends and colleagues, and of course on social media. We hope you find the information here useful!