Trusted Partners

What is a Merchant Cash Advance?

A merchant cash advance (MCA) is a lump-sum loan that a business or merchant repays by automatically drawing on a percentage of future debit and credit card transactions. Typically, cash advance loans have a shorter repayment period compared with other business financing options, as well as smaller and more frequent payments.

While cash advance loans are useful as a quick funding solution, they are normally reserved as a fallback plan if a business faces a tough financial situation without any alternative method of obtaining money. The reason small business cash advances are treated as a last-case-scenario is because the interest rates are notably higher than other types of business loans.

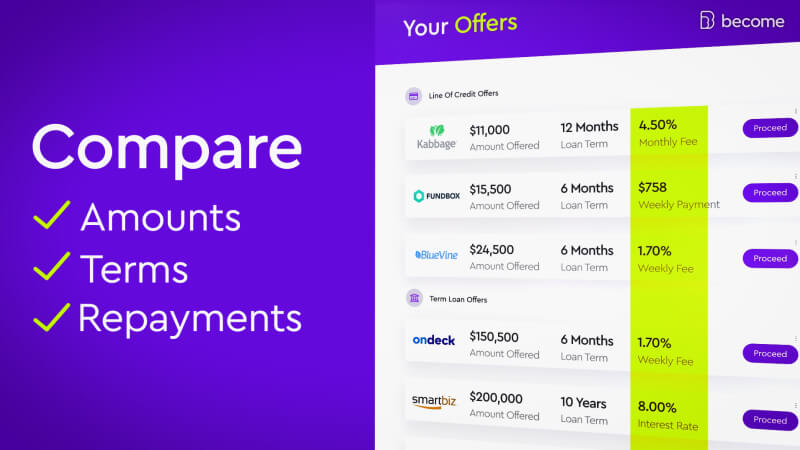

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

More About Merchant Cash Advances

Businesses that face difficult odds when applying for financing will be relieved to hear that qualifying for a merchant cash advance is generally much easier than qualifying for other forms of business funding. Whether your business has a poor credit score, has only been around for a short while, or you don’t have valuable assets to use as collateral - an MCA is still within your reach.

Important note: Merchant cash advances are a particularly useful funding option for small and medium businesses that conduct a large percentage of their transactions through debit and credit cards. So if, for example, you’re looking for restaurant loans, merchant advance funding would be a solution worth considering in the event of a financial rough spot.

Basic points to consider when applying for merchant cash advance loans:

1. What percentage of your business’s transactions are made by debit/credit card

2. How quickly you anticipate be able to repay the loan

Top Benefits of Merchant Cash Advances:

- Very young businesses can qualify

- Low credit scores may still qualify

- Can be used for any business-related purpose

- No need to worry about missing payments

- Fast approval and quick access to funds

Which Industries are Best Suited for Merchant Cash Advance Loans?

Merchant cash advances are flexible with regards to the way they can be used as a financial solution across such a wide variety of industries. It doesn’t matter if you're looking for a dental clinic loan, a loan for a trucking business, a construction company loan, or financing for any other industry- merchant advance funding can be the answer you’re looking for, regardless of which industry your business operates in.

A merchant cash advance is also extremely flexible in terms of its ability to be used for any business expense you need help covering. Your business may need help recovering after a disaster, or perhaps your industry’s slow season hit particularly hard this year, or maybe you need help with growing your auto repair business. Small business cash advances are useful for any kind of business-related expense.

Pros and Cons of Merchant Cash Advances

|

Pros |

Cons |

|

✔ Very easy to qualify ✔ Quick access to cash ✔ Can be used for any purpose |

? Higher interest rates ? Shorter repayment periods ? Irresponsible use can create cycle of debt |

How Does a Merchant Cash Advance Work?

When it comes to small business cash advances, the truth is your credit score won’t be the only factor. In fact, sometimes loan providers won’t even consider your credit score if you’re applying for a merchant cash advance. What lenders will look at primarily is your monthly revenue and, more specifically, the number of credit and debit card transactions that your business shows every month.

After applying for and receiving a merchant cash advance, your business will then pay back the loan amount incrementally by automatically drawing a certain percentage of your future credit and debit card transactions. The repayment period for merchant advance funding depends on the percentage drawn from those card transactions as well as the initial loan amount, but can be as short as 4 months.

As opposed to a standard interest rate, cash advance loans include what is called a ‘factor rate’ that the initial merchant cash advance amount is multiplied by; the factor rate normally ranges somewhere between 1.14 and 1.48.

For example, if the loan business cash advance amount is $10,000, the amount owed back would range somewhere between $11,400 and $14,800. While that doesn’t sound so bad on the face of it, when you consider the repayment term and the percentage taken from each credit card transaction, it can translate into annual percentage rates for some small business cash advances that reach into the triple digits. That’s reason to be careful when considering cash advance loans.

Why Become?

In general, business cash advances are a type of business funding solution that is conducted almost entirely online. That being the case, alternative lending platforms such as Become are the way to go if merchant advance funding is what you’re looking to obtain. But while so many online lending platforms promise a quick and easy application process, Become takes the digital lending experience to the next level.

With advanced algorithms, Become is able to provide small and medium sized business owners:

- Connection to dozens of the top lending partners in the United States and Australia

- Detailed financial assessment done automatically that take into account a variety of factors including business age, monthly revenue, existing debt, and more

- Tailored matching with funding solutions that you can qualify for and best suited to your needs depending on your requirements and profile

Bottom line: The best part of applying for merchant cash advance loans through Become is, whether you qualify or not, you'll receive access to a free personalized financial profile - through the LendingScore™ Dashboard - to help you improve your funding odds (with tools, tips and advice to help your business grow).

(there’s no risk to your credit score!)

How to Apply for Business Cash Advance

Step-by-step guide for applying for business cash advance:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Don’t think a merchant cash advance loan is the right financing option for you?

Do you still have questions and want to speak with one of our representatives? Feel free to reach out to us and we’d be happy to provide the answers!