Trusted Partners

All About Manufacturing Loans

Where the Manufacturing Industry Stands

The majority of manufacturing companies are actually considered small businesses; in fact, roughly 75% of the 250,000+ manufacturing firms in the U.S. have fewer than 20 employees. This is proof that the door is open for more manufacturing firms to enter the industry - great news for the prospective small business owner!

If that’s not enough to convince you of the viability of owning a manufacturing company, consider this: manufacturing made up 11.6% of the U.S. GDP in 2017, contributing roughly $2.33 trillion to the economy.

Still not convinced? The manufacturing industry employs roughly 8.5% of the entire U.S. workforce, which amounts to about 12.75 million workers. What’s more is that there’s still a shortage of workers in the manufacturing industry, with almost 90% of manufacturers having unfilled positions. While the shortage of workers is not such great news, it points to the fact that the demand on manufacturer output is high, which means opportunities for new players to enter the game and pick up the slack.

With all of that said, it’s still going to be costly to get the doors opened (and to keep them open). What is the solution to issues concerning manufacturing financing? We’ll touch on that just below.

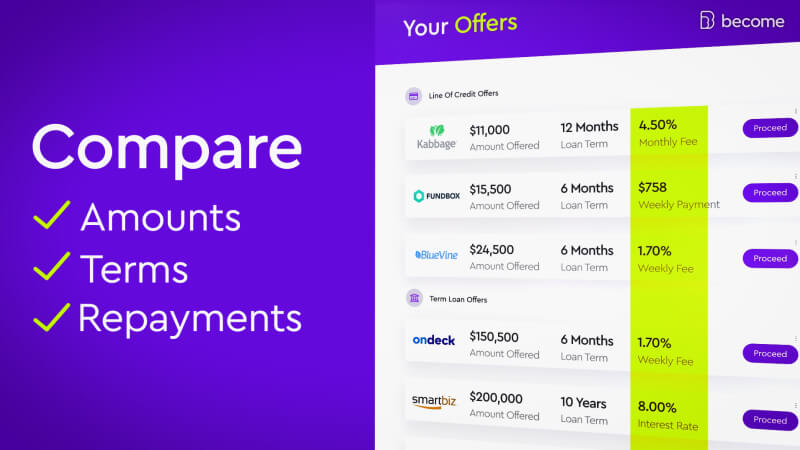

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

What Is Manufacturing Financing?

Manufacturing financing is the obtainment of funding for manufacturing businesses.

As is the case with so many other businesses and industries, for manufacturer business owners the question of how to finance a manufacturing company is going to arise sooner or later. There are a wide variety of expenses that come into play when running a manufacturing company, some of which are less obvious than others. We’ll dig deeper into the uses for manufacturing financing below, but suffice it to say that it will cost a pretty penny to get the business up-and-running.

That shouldn’t make you toss the idea of owning a manufacturing business out the window, because there is a true opportunity for financial success in this lucrative industry.

What Are the Best Manufacturing Financing Options?

Too many options can end up being a bad thing, so we’ve simplified the selection process for you by narrowing the list down and providing some useful information to help you compare. The table below provides a quick look at a handful of loan providers that can help you fund your manufacturing business.

|

Lending Partner |

Fundbox |

Kabbage |

Fora Financial |

OnDeck |

BFS Capital |

Bluevine |

|

Best used for |

Invoice financing & line of credit |

Line of credit |

Small Business Loan & Merchant Cash Advance |

Business term loans & Line of credit |

Small business loans & Merchant cash advances |

Invoice factoring & Line of credit |

|

Loan details |

||||||

|

Loan size |

$1,000 – $100,000 |

$2,000 – $250,000 |

$5,000 – $500,000 |

Credit lines up to $100,000, term loans from $5,000 – $500,000 |

$5,000-$500,000 |

$5,000 – $250,000, invoice factoring $20,000 – $5 million |

|

Repayment term |

12-week repayment term for line of credit, 12-week or 24-week repayment terms available for invoice financing |

6, 12, or 18 months |

Flexible |

3-12 months on short-term, 15-36 months on long-term |

Flexible |

6-12 months for credit line, 1-13 weeks for invoice factoring |

|

Qualifications |

||||||

|

Time in business |

At least 3 months |

1 year |

At least 6 months |

1 year |

1 year |

At least 3 months |

|

Minimum credit score |

n/a |

560 |

550 |

500 |

550 |

530 |

|

Annual revenue |

$50,000 |

$50,000 |

Minimum of $5,000 in credit card sales or $12,000 minimum in gross sales |

$100,000 |

Average daily bank balance of at least $1,500 |

$100,000 |

Not sure which provider you can qualify with? Check to see which you can qualify for with one simple application that won't harm your credit score:

Check if I qualify

Types of Manufacturing Financing

Equipment Finance

The world of manufacturing spans far and wide - you could be making heavy duty steel goods or making candies. Of course, the necessary machinery will differ from one business to the next. So, whether it’s for industrial fruit juicing machines, laser engraving machines, or steel bending machines, you can use manufacturing equipment financing to make the purchases you want (or need) without being left with mountains of debt.

Startup Business Loan

A small business loan for manufacturers can help you begin your company on the right foot. The best part about a startup loan for a manufacturing company is that you qualify without actually owning a business at the moment - which is a dream come true for aspiring manufacturing business owners!

SBA Loan

Let’s set the record straight: SBA loans don’t provide the funding for manufacturing business owners (or for any business for that matter) directly. Instead, the SBA acts as a safety net for borrowers and for lenders by guaranteeing up to 85% of the amount of the manufacturing loans they ‘provide’.

Business Line of Credit

A business line of credit is one of the best funding options for manufacturers. If there’s a particularly demanding billing cycle, or if clients take a while to pay their dues, a business line of credit can act as a backup source of manufacturing financing. A business line of credit works sort of like business credit cards, since you can use the funds on an as-needed basis.

A word of caution: Be careful with the amount (and type) of debt you build up - there is a difference between bad debt and good debt.

Unsecured Business Loan

The ‘unsecured’ part of this type of manufacturing financing means that you won’t need to provide collateral to qualify - this also means that the lender is taking a bigger risk than the borrower. On the other hand, the qualifying standards for unsecured business loans are more strict than for other types of loans for manufacturing companies. With that being the case, approval for this type of loan means higher chances of getting approved for other forms of loans for manufacturing businesses. On the bright side, unsecured loans can typically be repaid over a long period of time.

Merchant Cash Advance

If you’re searching for funding for a manufacturing business, a merchant cash advance (MCA) can be used as a temporary boost to your manufacturing financing. Help your business get through slow times or meet the expenses brought on by an emergency repair. The unique part about merchant cash advances that sets them apart from other manufacturing financing options is that they are repaid automatically. A percentage is drawn from future credit/debit card transactions, and the repayment period continues until the amount due is paid back.

What Can You Use Manufacturing Business Loans For?

Uses for manufacturing business loans include:

Labor Costs

This situation is repeating itself across many industries: there aren’t enough younger people to take the place of the last generation of workers. As the manufacturers of today hit their retirement age, the newer generations of Americans are being (and have been) encouraged to attend university and use their heads - not their hands - to make a living.

This is leaving a huge gap in the manufacturing workforce, with the manufacturing industry projected to be short by a whopping 2.4 million job positions over the next 10 years. A higher demand for skilled labor means considerable cost implications when it comes to hiring and training new employees.

Taking a manufacturing business loan is one viable solution to those rising expenses, and Become makes the application process quick and intuitive. You can get funding for your manufacturing company in as little as 3 hours!

Raw Materials

The definition of manufacturing is, “the making of articles on a large scale using machinery”. One of the first steps is to gather the raw materials which are to be used in the making of those “articles”. This can be anything from flour to make your signature chocolate chip cookies, to high tensile steel which will be made into helicopter blades.

The cost of materials for manufacturing will vary depending on several factors:

- The market supply and demand

- Your location

- The quality of the material

- The cost of transporting the material

- And more!

You can use a loan for a manufacturing company to cover the costs of your inventory at the outset or to maintain that inventory at times when the financial pressure begins to build.

Keeping Technology Up-to-Date

Related to the labor shortage in the manufacturing workforce is the continuous advancement of technology. As the workforce shrinks, new technologies have helped to bear the weight left over. Not only that, but all employees in the manufacturing industry - experienced and inexperienced alike - are starting to be expected to have some knowledge and expertise when it comes to those new technologies.

Another effect of the constantly evolving technology is that as each advancement is made, the last model of that improved machine is considered less effective or even obsolete. This creates a constant demand for manufacturers to buy new machines in order to keep up with their competitors who have already done so. That being the case, you should be sure to explore the pros and cons of equipment loans and equipment leasing.

Manufacturing equipment financing doesn’t need to jam your company’s gears. Apply for a business loan easily through Become where you can compare all your options in one place.

Staying Environmentally Conscious

While in the past, industrial manufacturers could get away with dumping waste into the nearby river or spewing out noxious gases into the sky, standards have (THANKFULLY) improved over time. Despite the indisputable positive impact these changes have made to the overall quality of life, they come at a cost.

As younger generations continue to be educated on the harms posed by environmental pollution, the standards continue to be raised, and the costs continue to increase. Unfortunately for those manufacturing companies that don’t care about our planet, stricter regulations will only become more commonplace as the years pass (if current manufacturing trends persist, that is).

Consider federal funding for manufacturing as you work to keep your company in line with environmental laws. The government has a wide variety of programs and initiatives aimed at making it easier for manufacturers to go green. Be sure to stay up-to-date on what sorts of federal funding for manufacturing are available.

Ensuring Cybersecurity

If cybersecurity is not on your priority list, you should reassess the level of seriousness you have when considering your intellectual property and even your finances. Cybercriminals are always developing new ways of infiltrating company computer systems in an effort to steal product blueprints and designs, but also bank information.

Defending against these sorts of cyber attacks is both crucial and costly. Cheaper options can run around $50 per year while more expensive (and more high end) services can cost upwards of $6,000 per year. The average cost of cybersecurity software is $1,400 - still much cheaper than the cost of having a breach in security, which can result in millions of dollars of damage. Be sure to include cybersecurity as part of your business disaster recovery plan.

Loans for manufacturing businesses are an effective way to meet the costs of keeping cybersecurity strong and up-to-date.

Other more general uses for manufacturing financing include marketing, rent, utilities, licenses/permits, and so on.

How to Apply for Manufacturing Business Loans

Step-by-step guide for applying for manufacturing loans:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Why Should I Apply for a Manufacturing Loan from Become?

Every business has its unique characteristics, and that’s why Become provides a valuable service to match you with the loan provider that best fits your financial profile by using fintech to change the business lending process. We have dozens of lending partners, each with its own interest rates and products. Apply for manufacturing loans today and find out which of our lending partners you may qualify with. The best part is there’s no risk to your credit score, no hidden obligation, and is completely free!

Become analyzes your financial profile with LendingScore™, a proprietary technology designed to find you a tailored match from our selected lenders. Our online application is intuitive and self-explanatory, acting as a guide for you throughout the process.

We improve your funding odds, unlock better funding opportunities for your business, and nurture your business throughout the funding cycle by providing a step-by-step improvement plan to further your funding success. Need funding for manufacturing businesses? Look no further!

Discover which manufacturing loans you may qualify for

Don’t think manufacturing financing is the right option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!