Using Become's services is entirely free of charge. Please be aware that our lending partners offer a range of business loan products, and interest rates and APR may differ among lenders. Rates will also depend on your individual qualifications.

All About Restaurant Loans

The restaurant business industry is one of the most demanding to get involved in, with 20% of restaurants failing within their first year of operation. But, getting the doors open is just the beginning. If you own a restaurant, then you will know that the expenses can quickly pile up. Employees have to be paid, inventory must constantly be restocked, you’ve got to obtain and renew permits, and the kitchen equipment has to be replaced - just to name a few.

Restaurant business loans are a smart solution for any restaurant that wants - or needs - to invigorate their cash flow, especially with so many being heavily reliant on the seasons. Perhaps you want to renovate and give your restaurant a fresh set of paint? Or maybe you’ve been thinking of scaling up the business by branching out and opening another location?

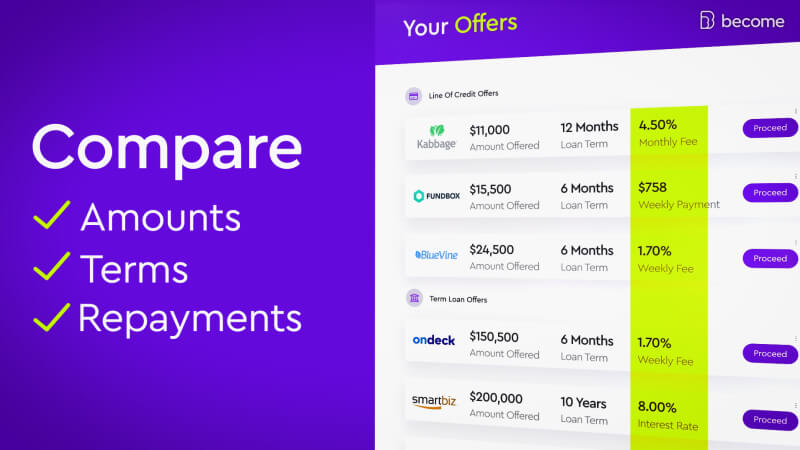

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

Types of Restaurant Financing

Due to the high rate of failure for restaurant businesses, banks normally don’t make it easy to get approved for a restaurant business loan. And even if your restaurant does get approved for a loan, the wait time of that process through the bank will be costly in-and-of itself. Luckily, there are a variety of alternatives when it comes to restaurant financing options that are willing to help your restaurant to defy those ugly statistics.

Start Up Business Loan

If you’re establishing a restaurant business from the ground-up, a start up business loan can provide you with the restaurant financing needed to get the ball rolling. This form of loan is especially helpful if you have the idea for your restaurant, but haven’t been able to put your plan into action. Your business can be very young to qualify for this type of loan, offering up a huge advantage for the prospective restaurant owner.

Qualifications & Features

- Credit score of 500+ for FICO

- Preferably 3 months in business

- No monthly revenue required (yes, you can have a revenue of $0 and still qualify!)

- Restaurant loans from $3,500 to $250,000

- Monthly repayment schedule

SBA Loan

The U.S. Small Business Administration (SBA) offers assistance to small businesses by guaranteeing up to 85% of a business loan amount - including restaurant business loans. This means that your restaurant can get funded even if you’re not sure if you’ll be able to pay the loan back in full. While an SBA loan doesn’t actually provide the funds itself, the safety-net that it provides to borrowers also gives lenders more incentive to approve applications for restaurant business loans. You can use this restaurant financing for anything from advertisement to purchasing new kitchen equipment.

Qualifications & Features

- Payback periods can range from 5 to 25 years

- Interest rates start at 6.5%

- Ideal time in business: 2 years

- Monthly repayment schedule

- Minimum monthly revenue: $0

- Minimum credit score of 500 for FICO

- Loans from $30,000 to $5,000,000

Business Line of Credit

Restaurants continuously need to restock their shelves, and the replacement rate of any given ingredient or product is always shifting. When your monthly expenses are unpredictable, your restaurant financing can rely on an open line of credit that allows your business to borrow-as-needed up to a set amount. A business line of credit is recommended as a safety net, providing your business with rainy-day funds when you need them most. Your business’s credit limit is based on the market value, profitability, and risk taken on by your restaurant - all of which are determined by your lender.

Qualifications & Features

- The basic requirements to qualify for this type of restaurant loan are that you do not exceed the credit limit and you meet the monthly minimum payments

- Interest rates vary according to factors designated by the lender (1%-10%)

- Time in business: 3 months minimum

- Minimum monthly revenue: $5,000

Equipment Finance

A restaurant’s productivity, as well as its quality, depends largely on the equipment that it uses in the kitchen. Everyone knows that making an egg on good non-stick pan is far better than an old, damaged one and can seriously change the outcome of the taste and texture. Here, the same principle applies. Whether you’re starting to piece together your kitchen from scratch, or your aim is to keep your establishment competitive in the industry, having up-to-date cooking apparatus is essential to running a successful and memorable restaurant. You can use restaurant equipment financing to make the purchases you want without digging yourself into a hole of debt. Also, be sure to consider the differences between equipment loans and equipment leasing before making a decision.

Qualifications & Features

- Even those with poor credit scores are often still eligible for these types of restaurant loans

- Repayment restaurant equipment financing can be made over a long period of time, often 2-6 years

- Interest rates typically range from 4-6%

Unsecured Business Loan

Unsecured small business loans for restaurants offer some of the best terms available for those with a relatively high credit score. Unsecured business loans require no collateral, which means that the lender is taking on a bigger risk than the borrower.

Qualifications & Features

- Qualification for an unsecured loan is generally more strict, but approval for this type means it will be easier to obtain other small business loans for restaurants

- Interest rates for this form of restaurant financing are generally higher than other forms of restaurant funding because there is no collateral put on the line

- Unsecured business loans can be repaid over a long period of time, usually a number of years

Merchant Cash Advance

For a quick short-term fix to your restaurant financing, a cash advance can be the solution. This method of restaurant funding is considered a last-case scenario if you need a quick boost to get you through a particularly demanding billing cycle. When revenue suffers from seasonal patterns, when your deep-freezer decides to quit on you without warning, or when you want to get the dining area redecorated, that’s when merchant cash advances come in handy. The amount your business is qualified to receive in the form of a cash advance generally depends on your credit score.

Qualifications & Features

- Repayment is done automatically by drawing from future debit and credit-card transactions

- Payment period lasts as long as it takes for the full amount to be repaid

- Minimum time in business: 6 months

- Minimum monthly revenue: $10,000

- Minimum credit score of 500 for FICO

Apply for MCA Loan

How to Use a Restaurant Loan

Restaurant funding is required for a wide array of reasons, some that are constant and some that are unpredictable.

Uses for Restaurant Business Loans:

- Paying rent and appliances (gas, water, & electricity)

- BOH (back of house) equipment; grills, ovens, refrigerators, freezers, etc.

- FOH (front of house) equipment; POS system, furniture, dishware, menus, etc.

- Paying employees (managers, hosts, waitstaff, busboys, cooks, dish cleaners, etc.)

- Restocking (food, ingredients, drinks, alcohol, cleaning supplies, etc.)

- Repairs (building, plumbing, electricity, etc.)

- Recovery after a disaster hits the business

- Decor (mirrors, light fixtures, carpeting, etc.)

- Advertisement (digital, print, signage, etc.)

While many of the expenditures listed here are frequent and routine, some payments can blindside even the most experienced restaurant owner. Balancing a restaurant’s budget requires a firm grasp on the normal.

How to Apply for Restaurant Loans

Step-by-step Process:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review the offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Apply for Restaurant Loans with Become

Your restaurant is unique in its own right, and that’s why Become tailor-fits the loan provider to your financial profile. We have over 50 lending partners, each with different interest rates and products. You can apply today for restaurant loans and find out which of our lending partners you may qualify with, and the best part is there’s no risk to your credit score and no hidden obligation.

Become works by analyzing your application with our LendingScore™ platform to find you the very best match possible with our selected lenders. Our online application is very straightforward and self-explanatory, acting as a guide for you throughout the process.

We improve your funding odds, unlock better funding opportunities for your business, and nurture your business throughout the funding cycle by providing a step-by-step improvement plan to further your funding success.

Discover what Become can do to help you improve your restaurant funding

Don’t think restaurant financing is the right option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!