Trusted Partners

All About Dental Practice Loans

Searching for the best dental practice financing? Then smile, because you’ve come to the right place!

If you’re in the dental industry (or just getting started in it) then you likely know how expensive it can be to get the doors open, as well as to keep it operating. With the average cost of starting a dental office running somewhere between $350,000 and $500,000, it’s inevitable that dental practice loans will come to mind.

Since you won’t want to bite off more than you can chew, we provide a rundown of the costs associated with dental practices and how to handle them wisely.

What are the best dental practice loans?

How do you get dental equipment financing?

What is dental practice financing used for?

We answer those questions, and much more, below.

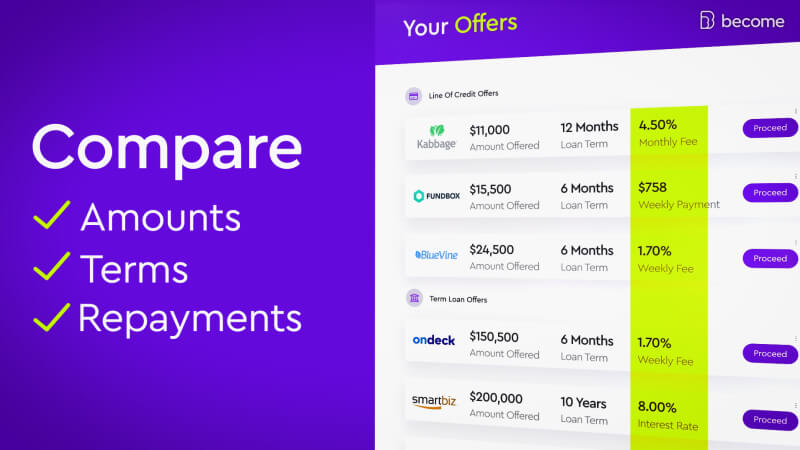

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

Financing Options for Dental Practice Loans

What Are the Best Dental Practice Loans?

Loans for dental practice come in so many varieties that the decision-making process can become dizzying. Fortunately, Become has found a number of lenders that stand out from the crowd, that way you don’t need to waste any time filtering through them yourself!

The chart below provides a sample of the best business loans for dentists you may qualify for when applying through Become.

|

Lending Partner |

Fundbox |

Kabbage |

Fora Financial |

OnDeck |

BFS Capital |

Bluevine |

|

Best used for |

Invoice financing & line of credit |

Line of credit |

Small Business Loan & Merchant Cash Advance |

Business term loans & Line of credit |

Small business loans & Merchant cash advances |

Invoice factoring & Line of credit |

|

Loan details |

||||||

|

Loan size |

$1,000 – $100,000 |

$2,000 – $250,000 |

$5,000 – $500,000 |

Credit lines up to $100,000, term loans from $5,000 – $500,000 |

$5,000-$500,000 |

$5,000 – $250,000, invoice factoring $20,000 – $5 million |

|

Repayment term |

12-week repayment term for line of credit, 12-week or 24-week repayment terms available for invoice financing |

6, 12, or 18 months |

Flexible |

3-12 months on short-term, 15-36 months on long-term |

Flexible |

6-12 months for credit line, 1-13 weeks for invoice factoring |

|

Qualifications |

||||||

|

Time in business |

At least 3 months |

1 year |

At least 6 months |

1 year |

1 year |

At least 3 months |

|

Minimum credit score |

n/a |

560 |

550 |

500 |

550 |

530 |

|

Annual revenue |

$50,000 |

$50,000 |

Minimum of $5,000 in credit card sales or $12,000 minimum in gross sales |

$100,000 |

Average daily bank balance of at least $1,500 |

$100,000 |

Types of Financing for Dental Practices

Equipment Financing

Whether it’s for dental patient chairs, X-ray imaging apparatus, or handheld dentistry tools, you can use business equipment loans for dental practices to make the purchases you want (or need) without being left with jaw-dropping amounts of debt. But, since equipment gets outdated quite rapidly in this day-and-age of constantly advancing technology, you may want to consider the differences between equipment loans and equipment leasing.

Startup Business Loan

A small business loan for dentists can get your office started right. The best part is, you don’t need to own a dental practice to qualify for startup business loans - which is great news for aspiring dental business owners!

SBA Loan

Although an SBA loan doesn’t actually provide the loans for dental professionals (or for any business for that matter), it does provide a safety net for borrowers by guaranteeing up to 85% of the loan amount. SBA loans also give lenders more incentive to approve applications for dental office loans.

Business Line of Credit

When your business is faced with a particularly demanding billing cycle, a business line of credit can work as a fallback source of dental practice financing. Generally speaking, a business line of credit works like business credit cards in that you can spend on an as-needed basis. Just be cautious not to dig yourself into an unreasonable amount of debt - there is a difference between bad debt and good debt.

Unsecured Business Loan

Since there’s no need to provide collateral to qualify for an unsecured business loan for dentists, the lender is taking a bigger risk than the borrower. With that said, it is more difficult overall to qualify for unsecured loans than for other types of dental practice financing. And since it’s harder to qualify for an unsecured business loan, if you do get approved then your chances of getting approved for other forms of loans for dental practices become greater. On the bright side, unsecured loans can typically be repaid over a long period of time.

Merchant Cash Advance

These types of dental practice loans are normally left as a last-case-scenario. A merchant cash advance (MCA), can be used to temporarily boost your dental practice financing, to help your dental practice make it through slower times of the year, or provide the funds needed to make an emergency repair. Unlike other forms of small business loans for dentists, merchant cash advances are repaid by automatically drawing a percentage from future credit/debit card transactions, and repayment lasts until the loan is paid back in full.

How to Get Dental Equipment Financing?

By now you’re well aware of the wide array of dental practice loans. Whereas the majority of loans for dental practices can be used for virtually any business-related expenses, equipment financing has a specific and specialized purpose.

The plain truth is, you simply can’t operate a dental practice without clean, up-to-date, and functioning equipment. You don’t necessarily need to purchase new tools though; equipment financing can be used to buy refurbished apparatus as well. While reusing certain kinds of dental practice equipment wouldn’t be advisable, something like a dental patient chair can be bought second-hand and nobody would be the wiser.

What’s more is that there are tools that a dental practice will need, but wouldn’t be the first items on most people’s lists. For example, computer hardware and software are crucial to running a modern dental office, but many people might overlook that as a potential way to use equipment financing.

Once you create a list of all of the equipment you’ll need to obtain for your dental practice (and the costs associated) it will become clearer why equipment loans for dental professionals are so useful.

What Can You Use Loans for a Dental Practice For?

The days of using a string and a swift throw of the door to extract a tooth are long gone. Indeed, technology has advanced so far that today there are lasers being used to perform oral surgery. It’s truly remarkable how far dentistry has come, but the impressiveness of the equipment comes at a price.

It’s not exactly cheap to start a dental clinic, nor is it the most affordable of professions in terms of keeping the doors open. You’ll need to stock up on a variety of large and small tools, all of which are essential to operating a modern, up-to-date dental practice. Below you’ll find a short list of the absolute necessities when it comes to dentistry equipment.

What every dental office needs:

- Restorative supplies and instruments for applying fillings, repairs, bonding, sealants, veneers, etc.

- Crown and bridge supplies including impression material, dispensing guns, sculpting lasers, etc.

- Dental utilities such as air compressor and vacuum pump

- Sterilizer

- Handpieces

- Dental patient chair

- Operating lights

- X-ray equipment

- Computer hardware & software

- Office intercom

This is just a small taste; the list of equipment you’ll need for a proper dental clinic will stretch far longer. A successful dental practice also requires a strong dental marketing strategy - so be sure not to let that fall by the wayside.

Don’t be shaken though - brace yourself! You’ll be grinning once you realize how easy obtaining dental practice financing can be.

How to Apply for Dental Practice Loans

Loans for dental professionals don’t need to take a huge bite out of your time. The process of applying for dental office loans through Become makes it quick and simple.

A step-by-step guide for applying for dental office loans:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Why Should I Apply for a Dental Practice Loan from Become?

Obtaining dental practice loans from traditional lenders, like big banks, can leave you gritting your teeth in frustration. The last thing you need when searching for the best dental practice financing is to waste your time jumping through bureaucratic hoops. It can take weeks to get finance from traditional loan providers. That's why alternative business funding options has become increasingly popular among business owners in need of financing.

That’s why Become is an ideal solution to the obstacles that stand in the way of small business loans for dentists. By using fintech to change the business lending process (namely with our proprietary LendingScore™ technology) we shave the application process down with our intuitive user interface, and match businesses with the lender that best fits their financial profile and needs in as little as 3 hours!

Advanced algorithms will assess and analyze your business’s financial factors to determine which of the dozens of lenders in Become’s network you may qualify with.

Want to know the best part of the Become experience?

You’ll receive tailored guidance to improve your fundability so that, even if you don’t qualify the first time, Become will keep helping until you get approved for a dental practice loan.

Get the best dental practice financing, and do it the smart way, with Become.

Discover which dental practice loans you may qualify for

Don’t think dental practice financing is the right option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!