Using Become's services is entirely free of charge. Please be aware that our lending partners offer a range of business loan products, and interest rates and APR may differ among lenders. Rates will also depend on your individual qualifications.

What are Unsecured Business Loans?

An unsecured small business loan is a form of business financing that simply doesn’t require any collateral in order to qualify.

And that’s great news for you! Why? It means that you won’t need to put your valuable items on the line and risk them being taken away from you should you fail to repay your loan. Collateral is essentially an asset that you own and agree to act as security for repayment (such as your house, vehicle, savings, inventory etc.)

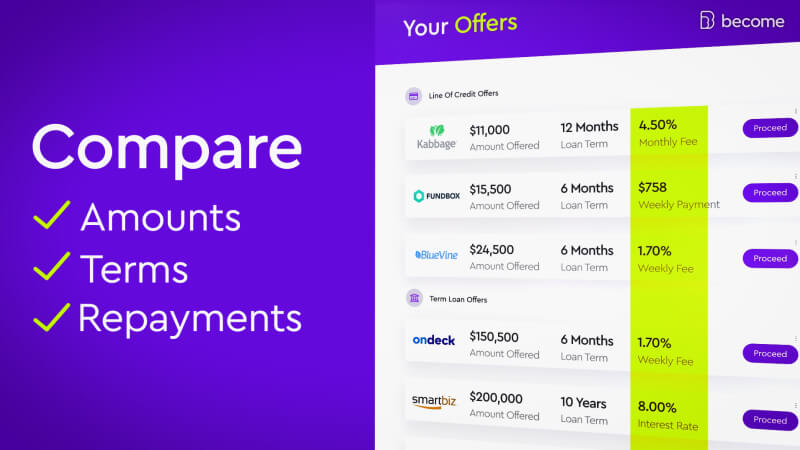

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

More About Unsecured Business Loans

Unsecured business funding has a clear advantage when compared with secured business loans, which place your assets at risk of getting repossessed if the business fails to make payments. On the other hand, secured business loans do have benefits of their own.

That makes unsecured business loans great for new businesses, and for business owners who do not have property or valuable equipment to put up as security. Unsecured business funding is a practical financial solution for companies in all different industries and across many different stages of development.

Unsecured business loans come in two general categories:

1. Unsecured Term Loans - payments are made until the total amount is paid back

2. Unsecured Lines of Credit - allow funds to be withdrawn and repaid repeatedly

Top 5 Benefits of Unsecured Business Loans:

- No collateral needed

- Fast application process

- Qualify with a low credit score

- Flexible loan amounts

- Easier to qualify for young businesses

There are a variety of specific loans that fall under the ‘unsecured’ category, but what they all have in common is the ability for borrowers to apply and get approved without needing to provide a form of collateral. It’s worth highlighting that often times lenders will require a personal guarantee signed by the business owner indicating his/her responsibility in the event that the business is unable to repay the debt.

Pros and Cons of Unsecured Business Loans

|

Pros |

Cons |

|

✔ No risk to personal assets (home, car, equipment, real estate) ✔ Simple and quick application process |

? Relatively higher interest rates ? Shorter repayment periods |

How Unsecured Business Loans Work

Depending on your business’s needs and LendingScore™ there are many different types of unsecured business loans available at your disposal.

The terms vary from around 1 year to up to 5 years. Some you can pay back monthly, others weekly, bi-weekly and even daily.

The loan amount and the interest rates will also vary again depending on your LendingScore™ - which includes funding factors such as your monthly revenue, business financials, credit score, business age and more. The better your score, the better rates and terms you can get.

Bottom line: Unsecured business loans vary depending on many factors - they are a wide financing category. To see what rates you can qualify for and check your LendingScore™ free of charge, apply here.

Who is better suited to apply for an unsecured small business loan?

In truth, an unsecured business loan can be used by many business types but they may be better suited to the following:

✔ Businesses without assets to use as security

✔ Businesses that need to get financing quickly

✔ Businesses with poor credit scores (350+ FICO score minimum)

✔ Businesses that can afford to pay slightly higher interest rates

✔ Businesses less than two years old

Credit Score Requirements for an Unsecured Business Loan

In short, they vary! But at Become we can help business owners with a credit score as low as 350 (FICO) here’s how...

Become is proud to partner with dozens of top lenders (in both the US and Australia) to not only offer easy and fast unsecured business loans, but to also increase the chances of getting approved for unsecured business funding (and business loans in general!). Above and beyond those perks, it also works to provide business owners with funding solutions which are tailored to their financial profiles and needs.

Your credit score does not need to be perfect!

What allows Become to match borrowers with the most optimal loan is that those loan providers all offer different products and services. This means that the terms and conditions (as well as unsecured business loan rates) will vary. Unsecured small business loans offered by the lenders in our network require FICO credit scores that can range as low as 350!

In other words, those with a tarnished credit history can still gain access to the funding they need but just keep in mind, those businesses with a stronger credit history will be offered more competitive interest rates as they will be seen as less risky. At the end of the day, interest rates reflect the risk that the lender is taking.

(psst, it won’t affect your credit score)

How to Apply for Unsecured Business Loans

Step-by-step guide for applying for unsecured business financing:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Don’t think an unsecured business loan is the right financing option for you?

Do you still have questions and want to speak with one of our representatives? No worries, we’re here to provide the answers!