Trusted Partners

All About Franchise Funding

Starting a business is not an easy or simple endeavor to pursue, that’s clear. But what’s even more difficult is starting a business from absolute zero, without any idea of what works and what doesn’t.

For prospective business owners who want a tried-and-true route towards success and profitability, becoming a franchisee is one option that’s worth serious consideration. Of course, there are some questions that need answering before taking the step towards becoming a franchisee.

- What is a franchise business?

- What are the costs of opening a franchise?

- Is a franchise business right for you?

- How do you obtain franchise funding?

Below, we dive into the wide world of franchise businesses to explain all there is to know about franchise opportunities and how you can make the most of them.

Franchise 101 - What is a Franchise Business?

Let’s start with the basics.

According to Investopedia, a franchise is “a type of license that a party (franchisee) acquires to allow them to have access to a business's (the franchiser) proprietary knowledge, processes, and trademarks in order to allow the party to sell a product or provide a service under the business's name.”

They continue, “In exchange for gaining the franchise, the franchisee usually pays the franchisor an initial start-up and annual licensing fees.”

For example, one of the most famous franchises is McDonald’s. When somebody opens a McDonald’s, they don’t have full proprietary rights over how that branch is operated. The owner of that branch is a franchisee of McDonald’s Corporation, and must follow the operating criteria that are dictated to them by the corporation.

While that may sound a bit stifling for someone who wants to run their own business, the benefits that are offered by opening a franchise are a big incentive.

In the case that you already own a company, it’s definitely worth considering the pros and cons of franchising a business.

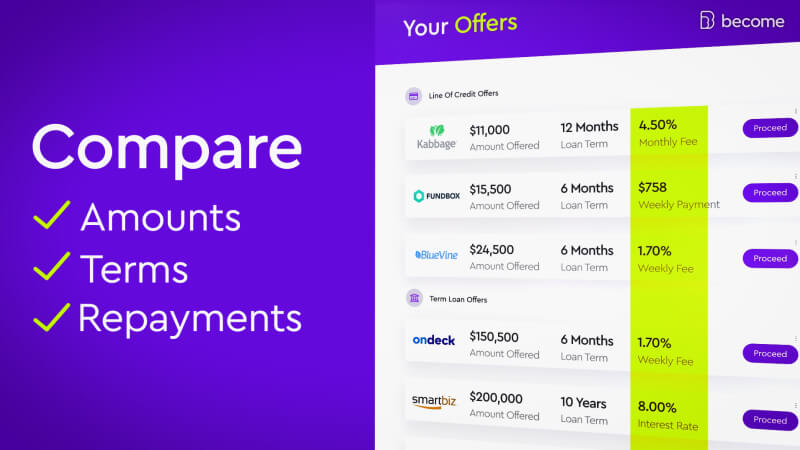

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

Where the Franchise Industry Stands

Franchise opportunities are in no short supply - there are roughly 750,000 franchise establishments in the United States employing approximately 18 million people. Add to that the fact that franchise industry makes up roughly 3% of US GDP and has a projected growth rate of 1.9% over the next year, and it starts to become clear that it has a lot to offer.

Logic would suggest that, since so many people have seized franchise opportunities, there must be real advantages to franchise ownership (as opposed to traditional small business ownership).

Benefits of opening a franchise include:

- Brand recognition - because they’ve been established and proved their business model as successful, it’s understandable that a franchiser’s name is well-known among customers. Since that’s the case, customers will be more likely to buy your product without second-guessing the quality of service or product.

- Higher success rate - once again, since the company has already proven its business model, it’s much more likely to succeed again when compared to a startup that hasn’t been tempered by exposure to the real market.

- Easier to obtain franchise business loans - loan providers want to minimize their own risk when lending money to a prospective business owner. Franchise funding is typically less difficult to get approved for. Small business loans for franchise businesses are generally easier to secure because lenders will be assessing a business plan which has already been tested and has proved its viability.

- Not necessary to have experience - many franchise opportunities will provide you with training in order to maintain a consistent company culture from one branch to the next. This offers a big benefit for those potential business owners who lack the business experience to start their own company from scratch.

“Franchising and unemployment are positively correlated. When unemployment rises, more people look to franchising as a means of ‘buying’ a stable job. This is an attractive opportunity for many as it combines the safety net of the franchise model with the relative stability and independence of business ownership.” - Chris Meyers

But just as is the case with most good things in life, there is still a cost associated with opening a franchise - and those costs aren’t only monetary.

What are the Costs of Opening a Franchise?

While the advantages of opening a franchise can be enticing, it’s just as important (if not more important) to consider the costs and risks associated with opening a franchise. While franchise funding made it onto the ‘benefits’ list, there are still other important factors to keep in mind when thinking about opening a franchise business.

The cost of opening a franchise can range from a few thousand dollars to a few million - that includes the fees associated with obtaining rights to trademarks, making deposits, furnishing the store, making sure all logistic codes and regulations are obeyed, landscaping, supplies and inventory, and so on.

Together, these are referred to as build-out costs. Much of the time the franchisor will provide an estimate for your build-out costs.

Risks and costs of opening a franchise:

- Little room for flexibility - opening a franchise means signing a contract with the franchisor, who will provide strict guidelines on:

- how to operate the business/how to shape customer experience

-

- where the business will be located

-

- which products and services you’ll be permitted to offer

-

- where you supply your inventory

- Damage by association - since the name of your business will be shared by many branches, if the quality of service lacks at one location it will, unfortunately, reflect on your establishment. It’s important to research how the corporation handles that sort of situation before entering into an agreement with them.

- Ongoing franchise fees - besides the initial build-out fees, there are fees that will continue to be imposed on your establishment for as long as it operates under the franchisor. The average ongoing franchise royalty fees “typically range from 4 percent to 8 percent of gross revenues and include an ongoing assessment for a joint marketing and advertising fund (about 2 to 4 percent).”

- No obligation for franchisors to renew contract - since the franchisor owns all of the rights to the knowledge, processes, and trademarks, they maintain the right to decide not to renew the contract you signed with them. What this really means is more risk on the part of franchisees, since they never know when their location might be shut down.

What Are the Best Franchise Funding Options?

SBA Loan

By covering up to 85% of a business loan amount, the SBA (U.S. Small Business Administration) provides help to small businesses - including SBA franchise loans. In plain English, SBA loans give prospective business owners have a way to obtain small business loans for franchise even if they don’t feel entirely confident that they’ll be able to repay the loan.

Even though SBA franchise loans aren’t providing the money directly to the borrower, the security that they provide for borrowers also serves lenders by giving them more reason to approve applications for franchise business loans. Franchise funding options aren’t such a headache when you’ve got SBA franchise loans at your disposal.

Qualifications & Features

- Minimum credit score of 500 for FICO

- Ideal time in business: 2 years

- Interest rates as low as 6.5%

- Minimum monthly revenue: $0

- Loans from $30,000 to $5,000,000

- Monthly repayment schedule

- Payback periods range 5 - 25 years

Start up Business Loan

Franchise financing options are more limited when you’re establishing the business from nothing. Start up business loans are among the best franchise funding options for new business owners. You can qualify for start up business loans even if you’ve never owned a business before!

Qualifications & Features

- Credit score of 680+ for FICO

- Preferably 3 months in business

- Rates as low as 0%

- No monthly revenue required (yes, you can have a revenue of $0 and still qualify!)

- Small business loans for franchise from $3,500 to $250,000

- Monthly repayment schedule

Financing from Franchisor

Franchisors have an incentive to make financing more readily available to both potential franchisees and their existing franchisees. For that reason, many franchises have begun offering funding solutions to franchisees.

Qualifications & Features

- Each franchise company has different requirements that need to be met in order to qualify

- Research the brand before signing any contracts, read their Franchise Disclosure Document

- Speak with other franchisees who have taken this route to understand how their experience compares with other franchise funding options

There are other franchise financing options worth taking into account, including business credit cards. While they typically won’t be able to cover all of the expenses in one shot, credit cards can help you afford the fees associated with opening a franchise.

Now that you’ve got an overview of the different franchise financing options, it’s time you get a better idea of franchise financing lenders available.

Where to Get Franchise Loans

Wondering where you should obtain your franchise funding? No longer are business owners limited in their options for finding and obtaining financing - alternative business funding options have changed the lending landscape. For your convenience, the table below provides you with a list of the top franchise financing options available today, along with everything you need to compare them wisely.

|

Lending Partner |

Fundbox |

Kabbage |

Fora Financial |

OnDeck |

BFS Capital |

Bluevine |

|

Best used for |

Invoice financing & line of credit |

Line of credit |

Small Business Loan & Merchant Cash Advance |

Business term loans & Line of credit |

Small business loans & Merchant cash advances |

Invoice factoring & Line of credit |

|

Loan details |

||||||

|

Loan size |

$1,000 – $100,000 |

$2,000 – $250,000 |

$5,000 – $500,000 |

Credit lines up to $100,000, term loans from $5,000 – $500,000 |

$5,000-$500,000 |

$5,000 – $250,000, invoice factoring $20,000 – $5 million |

|

Repayment term |

12-week repayment term for line of credit, 12-week or 24-week repayment terms available for invoice financing |

6, 12, or 18 months |

Flexible |

3-12 months on short-term, 15-36 months on long-term |

Flexible |

6-12 months for credit line, 1-13 weeks for invoice factoring |

|

Qualifications |

||||||

|

Time in business |

At least 3 months |

1 year |

At least 6 months |

1 year |

1 year |

At least 3 months |

|

Minimum credit score |

n/a |

560 |

550 |

500 |

550 |

530 |

|

Annual revenue |

$50,000 |

$50,000 |

Minimum of $5,000 in credit card sales or $12,000 minimum in gross sales |

$100,000 |

Average daily bank balance of at least $1,500 |

$100,000 |

How to Apply for Franchise Loans

Step-by-step guide to applying for franchise business loans:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

What Can Franchise Loans Be Used For?

The bottom-line reason for obtaining franchise funding is to further business development. But that can meet many different things; when it comes to franchise funding, the uses can vary far and wide. If you're looking for a business loan to help with scaling up a business or recovering the business after a disaster hits, you may want to explore different financing options. Here, we’ll give you a rundown of how to use franchise funding to its fullest potential.

Top ways to use franchise funding:

Franchise Fee

Regardless of which franchise brand you are looking at, there will always be a franchise fee which is charged at the outset. While most franchises will charge somewhere between $20,000 and $50,000, it can be much lower (if it’s home-based) or much higher (if it’s a very well-known company that’s highly profitable). Franchise business loans can help you get the ball rolling.

Build-out Costs

Build-out costs encompass an array of expenses that relate to the physical establishment of the branch that you intend on opening. By obtaining franchise funding from one of the many franchise financing lenders available, you can make these expenses more affordable.

Charges that would fall under build-out costs include:

- Furniture

- Signs/ads

- Equipment (read more about business equipment loans)

- Fixtures

- Contractor fees

- Architectural fees

- Zoning fees

- Landscaping

- Insurance

Legal Fees

When considering becoming a franchisee, it’s crucial that you review all of the documents that are part of the process. Those documents include the Franchise Disclosure Document (FDD) and the franchise agreement. There’s normally quite a bit of paperwork involved in filling and reviewing those forms, so it’s always advised that you hire a qualified professional franchise lawyer to guide you through the process.

The costs involved with legal paperwork will vary depending on the attorney’s rates and how much time you spend with them, but you should prepare to spend somewhere between $1,500 and $5,000. Use franchise funding to cover the legal fees of starting your business.

Supplies/Inventory

Whether you’re talking about usable or consumable products, your company will inevitably need to stock, and restock (and restock…) its shelves. Since every business offers different services, the products required to maintain operational status will vary. Naturally, the costs will also be different from one company to the next.

While your franchisor may very well provide you with an estimate of the overall costs associated with supplying your business, you’ll want to take some time to evaluate the franchise funding options that you can use to cover those expenses.

Working Capital

Working capital is essentially the amount of money available for the business to use daily. The amount of cash that any specific franchisee will need on hand on a day-to-day basis is going to vary depending on the brand.

Normally the franchisor will give its franchisees an estimate for the amount of working capital they’ll need. The amount of money necessary to have on hand is typically determined based on the length of time that the working capital should be able to cover business expenses (can be a number of months, or a number of years).

Why Should I Apply for Franchise Business Loans from Become?

Sifting through the endless list of franchise financing lenders can be a tiring task, but it doesn’t need to become a headache. Become helps prospective and existing franchisees match with the optimal franchise financing options by using fintech to improve the lending process - dozens of lending partners have already joined the network.

By using the most up-to-date, cutting-edge algorithms, Become is able to assess your financial profile quickly so that you can get your franchise funding in as little as 3 hours! With the insight provided by analyzing your business’s health, Become provides an experience that is tailored to your business’s specific needs.

The best part about the service offered by Become is that, whether you qualify or not, you’ll receive guidance on how to improve your fundability. The most unique part of the Become experience? It’s completely risk-free, and there’s no charge associated.

So what are you waiting for? Find out how to obtain small business loans for franchise today!

Discover which franchise financing options you may qualify for

Don’t think franchise financing is the right option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!