Trusted Partners

All About Auto Repair Shop Loans

Where the Auto Repair Industry Stands

Owning and operating an auto repair business certainly comes with its fair share of hurdles, but where there is a challenge there is an opportunity. That’s precisely the reason why there are small business owners who continue to invest their time, energy, and money into auto repair shops.

With more than a quarter of a million auto repair businesses open across the United States that employ over half a million people, it’s no mystery how the total revenue generated by the auto repair industry was able to reach $69 billion in 2019.

These numbers are impressive and are projected to continue growing for the foreseeable future at a rate of 2.5% annually. And when you take into account the fact that just 25% of all auto repairs are conducted at car dealerships, it becomes clear that there’s a lot of room for small and medium-sized business owners to stake their claim in the auto repair shop industry.

Having taken the current state of the industry into consideration, it’s important to highlight the plain truth that auto repair is not the easiest nor the cheapest business to work in, but surely worthwhile. How can you overcome the financial hurdles that lie ahead?

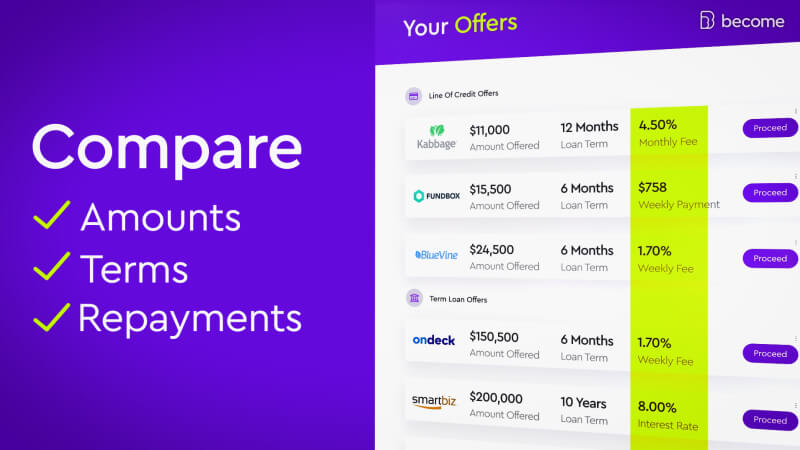

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

What are Auto Repair Business Loans?

Running an auto repair shop requires grit and dedication - it’s not a task for the weak-willed, that’s for sure. But even with the right attitude, the costs of owning and operating an auto repair business can leave the most experienced business owner wide-eyed and slack-jawed. And, the expenses involved in running an auto repair shop vary widely. That’s why it’s important that business owners have auto repair shop financing available at a moment’s notice.

What are auto repair business loans? They are financial solutions to expense-related obstacles that keep auto repair businesses from operating at full capacity in one way or another. But what might some of those financial obstacles be? And how does auto repair shop financing really work?

What are the costs of running an auto repair shop?

There are many costs when it comes to operating an auto repair shop. Here, we list the top 3.

Top 3 costs of running an auto repair shop:

1. Equipment

Whether we’re talking about engine hoists, vehicle lifts, or air compressors - the price tag isn’t going to be small for auto repair shop equipment. And, in today’s day and age, it’s not enough to just take care of those equipment essentials. We also see that vehicles are continuing to get ‘smarter’, which means a higher demand for auto repair businesses to adopt advanced technology for diagnosing issues. The fact is, equipment for auto repair shops cost a pretty penny, and auto repair shop loans can help cover those costs. (More on business equipment loans below).

2. Insurance

It’s also true that insurance premiums for liability coverage are far from cheap, and those expenses typically will reflect a higher cost in services provided by the auto repair business. Auto repair shop financing can help to cover the cost of insurance for your business, and ultimately help avoid increasing the price of services for clients.

3. Rent

Being located in an area with lots of traffic drastically increases the ability for the business to succeed; more cars means more potential customers. In order for lots of clients to come into the shop, there will also need to be plenty of parking space as well as an area for cars to be stored while being worked on. Locating the business in a high-traffic area may very well translate to rent and taxes that are financially demanding.

Whatever way, shape, or form the cost comes in, auto repair shop loans are an important part of operating a healthy auto repair business.

What Are the Best Business Loan Options for Auto Repair Shops?

|

Lending Partner |

Fundbox |

Kabbage |

Fora Financial |

OnDeck |

BFS Capital |

Bluevine |

|

Best used for |

Invoice financing & line of credit |

Line of credit |

Small Business Loan & Merchant Cash Advance |

Business term loans & Line of credit |

Small business loans & Merchant cash advances |

Invoice factoring & Line of credit |

|

Loan details |

||||||

|

Loan size |

$1,000 – $100,000 |

$2,000 – $250,000 |

$5,000 – $500,000 |

Credit lines up to $100,000, term loans from $5,000 – $500,000 |

$5,000-$500,000 |

$5,000 – $250,000, invoice factoring $20,000 – $5 million |

|

Repayment term |

12-week repayment term for line of credit, 12-week or 24-week repayment terms available for invoice financing |

6, 12, or 18 months |

Flexible |

3-12 months on short-term, 15-36 months on long-term |

Flexible |

6-12 months for credit line, 1-13 weeks for invoice factoring |

|

Qualifications |

||||||

|

Time in business |

At least 3 months |

1 year |

At least 6 months |

1 year |

1 year |

At least 3 months |

|

Minimum credit score |

n/a |

560 |

550 |

500 |

550 |

530 |

|

Annual revenue |

$50,000 |

$50,000 |

Minimum of $5,000 in credit card sales or $12,000 minimum in gross sales |

$100,000 |

Average daily bank balance of at least $1,500 |

$100,000 |

Apply for Auto Repair Shop financing

Types of Auto Repair Shop Financing

Best Auto Repair Shop Loans for Equipment: Equipment Finance

Auto repair equipment comes in many, many different shapes and sizes. There are the big ticket items like vehicle lifts and air compressors, as well as somewhat smaller items like brake lathes, transmission jacks, oil caddies, and strut compressors. Regardless of what type of equipment you need to purchase, replace, or fix, auto repair business loans can be the right solution.

Qualifications & Features

- Auto repair shops with bad credit are often still eligible

- Interest rates from 4-6%

- Repayment period: 2-6 years

- No need to pay assets in full

Best Auto Repair Shop Loans for Early Stages: Startup Business Loan

The first stages of business development can be bumpy, and it may take a while before you’re able to get your legs under you. To survive those beginning phases, it’ll take lots of effort and patience, as well as financing. So don’t stall out before you truly get started! Use auto repair shop financing to make it past the first mile-marker.

Qualifications & Features

- FICO credit score of 680+

- Minimum 3 months in business

- Interest rates as low as 0%

- No monthly revenue required (yes, you can have a revenue of $0 and still qualify!)

- Auto repair shop loans ranging $3,500-$250,000

- Monthly repayment schedule

Best Auto Repair Shop Loans for General Purposes: SBA Loan

Although the U.S. Small Business Administration doesn’t directly provide the funding to auto repair shop owners, SBA loans do guarantee up to 85% of the loan. In that way, the SBA acts as a ‘safety net’ for borrowers and for lenders, making it easier on all parties involved. SBA auto repair shop loans are among the easiest to qualify for.

Qualifications & Features

- FICO credit score of 500+

- Ideally 2 years in business or more

- Interest rates starting at 6.5%

- No minimum monthly revenue required

- Loans ranging $30,000-$5,000,000

- Monthly repayment schedule

- Payback period: 5 - 25 years

Best Auto Repair Shop Loans for Occasional Access to Funds: Business Line of Credit

When an auto repair shop faces a demanding billing cycle, or if there are emergency repairs that need to be made from weather damage, or if seasonal changes slow down the cash flow - a business line of credit is one of the best solutions available. The same way business credit cards work on an as-needed basis, a business line of credit is there for when you need it.

Just be wise and responsible about how much debt you build up - there are important differences between bad debt and good debt.

Qualifications & Features

- Fundamental requirements to qualify:

- Stay within the credit limit

- Pay monthly minimum

- Time in business: at least 3 months

- Minimum monthly revenue: $5,000

- Interest rates range 1%-10%

- Pre-arranged repayment schedule

Best Auto Repair Shop Loans for Low Risk and Large Sums: Unsecured Business Loan

Unsecured auto repair business loans offer business owners a way to obtain financing without providing collateral as a requirement to qualify. What that translates to is less risk for the borrower, but also stricter parameters on the other requirements to qualify. All of that said, one of the best parts about unsecured business loans is that, if you do qualify, it becomes much easier to qualify for other forms of auto repair shop financing.

Qualifications & Features

- Shorter approval process: 48-72 hours

- Interest rates normally higher than most other loans

- Shorter repayment period: 3-18 months

Best Auto Repair Shop Loans for Short Term Boost to Cash Flow: Merchant Cash Advance

Of all the types of auto repair shop financing, a merchant cash advance (MCA) is the one that is usually recommended as a last-case-scenario solution. The reason being that they tend to have higher interest rates compared to most kinds of business loans for auto repair shops. What really sets an MCA apart from other loans for auto repair shops is that the repayment is made by automatically drawing a percentage from future credit and debit card transactions.

Qualifications & Features

- FICO credit score 500+

- At least 6 months in business

- Minimum monthly revenue: $10,000

- Repayment by automatically drawing from future debit and credit card transactions

- Payment period lasts until full amount is repaid

What Can You Use Loans for an Auto Repair Business For?

What is auto repair shop financing good for? Furthering business development, of course! There are lots of ways to use loans for the improvement of auto repair shops - here we list the top three.

1. Basics

The everyday operation of an auto repair shop will take its toll on your bank account, and that’s why business loans for auto repair shops are so handy. Whether it’s used for training and hiring new mechanics, buying supplies and tools, or simply covering unforeseeable expenses, it’s clear that the varied costs involved in running an auto repair shop will be taxing. Auto repair shop financing is not reserved for companies in need though - they can be just as useful for business owners who want to make improvements as well.

2. Marketing and Advertising

With there being such a healthy level of competition in the auto repair industry, it is crucial to stand out from the crowd effectively. Loans for auto repair shops are often times used to improve the company’s exposure in order to bring in more customers. While billboards and newspaper ads still make their impact, it’s becoming increasingly important to develop and maintain an online presence as well. Use auto repair shop loans to establish a top-notch website, and to establish a personality on social media platforms.

3. Scaling up Business

Scaling up a business takes careful consideration, planning, and timing. But, for those businesses that have done well and want to continue growing, auto repair shop loans can help take the company to the next level. Whether it means hiring more mechanics, building an addition, or relocating to a more profitable location, auto repair business loans can make scaling up easier on your wallet.

How to Get Approved for an Auto Repair Shop Business Loan

There are a number of factors that can impact your ability to qualify for business loans for auto repair shops. If you’ve been denied in the past and aren’t exactly sure why then you’ll want to review the following three points to improve your approval rating.

1. Up Your Monthly Revenue

Many loan providers will look at your monthly revenue as an indicator of your ability to repay the loan on time. If it’s apparent that your revenue is less than impressive, see what you can do to create recurring revenue streams. For example, subscription services may create an incentive for customers to return in order to capitalize on promotions. Subscriptions may also generate more word-of-mouth advertisement as customers share the offered perks with their friends and family.

2. Clean Up Your Credit Score

Your credit score is one of the most fundamental factors that loan providers will assess when considering your loan application. While the required score will vary from one lending institution to the next, it’s important to realize that the better your credit score is, the higher the chances are of approval and the better loan offers you’ll receive. Need to improve your credit score but don’t know where to start? You can use credit cards to improve your credit score - just be sure to go about it wisely in order to reach your target credit score.

3. Take a Closer Look at Your Cash Flow

Cash flow is the total amount of money transferring in and out of the company. Lots of the time, businesses may have what it takes to qualify for business loans for auto repair shops, but have unfortunately failed to optimize their budgeting. Be sure to take a look at your business’s cash flow to see where you may be able to make adjustments that will improve your profit margins and improve your chances of getting approved for auto repair shop financing.

How to Apply for Auto Repair Shop Loans

Step-by-step guide for applying for auto repair shop loans:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Why Should I Apply for an Auto Repair Business Loan from Become?

Applying for small business loans for auto repair shops through banks is a complicated process that takes lots of time and paperwork. And, more importantly, the odds of getting approved are slim for most applicants. Don’t waste any more time or resources chasing your tail and jumping through bureaucratic hoops.

Become offers businesses a fast and simple way to apply for business financing. By using advanced algorithms to quickly and efficiently analyze your business’s financial health, Become is able to match you with the loan provider that best matches your profile. And with dozens of loan providers in our network, your chances of approval are that much better.

What sets Become apart most of all is the tailored guidance that it provides businesses to improve their fundability. Everything your business will need to do in order to get approved for auto repair shop financing is shown on your unique LendingScore™ dashboard. And the best part is that it’s completely free!

Get the best auto repair business loans the smart way with Become.

Discover which auto repair shop loans you may qualify for

Don’t think auto repair shop loans are the right option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!