Trusted Partners

All About Real Estate Agent Loans

There are a variety of new financing options that have opened up the market for new real estate businesses to profit. Those new types of funding for real estate agents include microloans, SBA loans, private lenders, online lenders, and so on. If you want a loan to start a real estate business or for any other purpose, there are a number of types of small business loans for real estate agents. Each offers unique benefits which make them more useful to handle certain types of expenses.

Over recent years, the demand for real estate agents across the United States has been growing. In fact, since 2012 the number of National Association of Realtors members in America has increased by more than 30%, reaching an all-time high of over 1.36 million individuals. Additionally, data projections suggest that employment among real estate firms of less than 2,500 employees is going to increase through 2026.

Below, we give a full breakdown of the variety of small business loans for realtors with the goal of making the search for the right funding option easier.

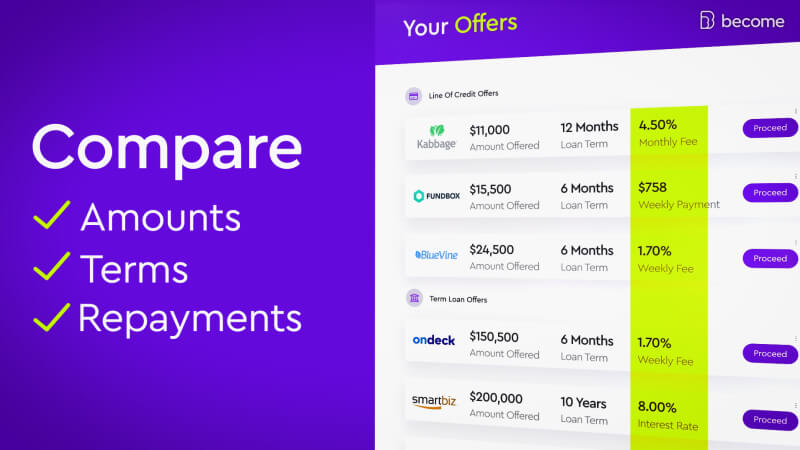

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

What Are Small Business Loans for Realtors?

Small business loans for realtors are, as the term suggests, types of financing solutions meant for real estate agents to use in order to cover expenses related to the functioning of their business. Looking for a loan to start a real estate business? On a mission to improve your real estate marketing strategy? Need new tech in order to get a firmer grip on tracking your business’s performance?

The possible ways to use funding for real estate agents are virtually endless, which is why there are a variety of kinds of small business loans for realtors.

Small Business Loans for Realtors: What Are the Best Options?

Small business loans for real estate agents can be used for a variety of purposes. Ultimately, choosing the best funding option will boil down to several factors, including what you need the business loans for and how eligible you are as a borrower in the eyes of the lender.

Do you have clients who aren’t paying their invoices on time? Are you looking to open a second base of operations for your real estate business? Need money available on-demand to help you cover unexpected expenses? Whatever you need help getting done, funding for real estate agents can be the solution you’re searching for.

|

Lending Partner |

Fundbox |

Kabbage |

Fora Financial |

OnDeck |

BFS Capital |

Bluevine |

|

Best used for |

Invoice financing & line of credit |

Line of credit |

Small Business Loan & Merchant Cash Advance |

Business term loans & Line of credit |

Small business loans & Merchant cash advances |

Invoice factoring & Line of credit |

|

Loan details |

||||||

|

Loan size |

$1,000 – $100,000 |

$2,000 – $250,000 |

$5,000 – $500,000 |

Credit lines up to $100,000, term loans from $5,000 – $500,000 |

$5,000-$500,000 |

$5,000 – $250,000, invoice factoring $20,000 – $5 million |

|

Repayment term |

12-week repayment term for line of credit, 12-week or 24-week repayment terms available for invoice financing |

6, 12, or 18 months |

Flexible |

3-12 months on short-term, 15-36 months on long-term |

Flexible |

6-12 months for credit line, 1-13 weeks for invoice factoring |

|

Qualifications |

||||||

|

Time in business |

At least 3 months |

1 year |

At least 6 months |

1 year |

1 year |

At least 3 months |

|

Minimum credit score |

n/a |

560 |

550 |

500 |

550 |

530 |

|

Annual revenue |

$50,000 |

$50,000 |

Minimum of $5,000 in credit card sales or $12,000 minimum in gross sales |

$100,000 |

Average daily bank balance of at least $1,500 |

$100,000 |

(your credit score won't be harmed!)

Still wondering what the best funding options for real estate agents are? Here you have them:

1. Best Realtor Business Loan for Emergency Backup Funds: Business Line of Credit

Unforeseeable expenses will inevitably arise throughout the operation of a real estate business, that’s a fact. Whenever you need extra funds to cover surprise costs, a business line of credit will come in handy. They essentially work the way a credit card does, where you’ll have access to money on an as-needed basis.

Additionally, business lines of credit are typically revolving, which means you’ll be able to withdraw funds, repay them, and then use them again indefinitely. Be sure to compare term loans and lines of credit before making your decision.

2. Best Realtor Business Loan for Big Expenses: Unsecured Business Loan

The ‘unsecured’ part of this type of funding for real estate agents means that you won’t be required to provide valuable assets as collateral. That significantly reduces the risk that you the borrower take on, and shifts that risk to the lender (since they won’t be able to repossess your assets if you fail to repay).

On the other hand, the interest rates for unsecured business loans are generally higher than they are with other small business loans for realtors. And since getting approved for an unsecured business loan is somewhat more difficult than other loan types, if you do qualify it will make it that much easier to qualify for those other types of loans.

3. Best Realtor Business Loan for Slow-Paying Clients: Invoice Factoring

For real estate agents, slow-paying clients can become a serious issue which negatively impacts their cash flow. As part of the strategy for dealing with unpaid invoices, consider invoice factoring. Instead of waiting around for those payments to come in, a third-party lender can pay you a lump sum loan of up to 80% of the unpaid invoices value and then collect those payments on your behalf.

Qualifying for this type of small business loan for realtors is quite easy, as the lender will consider your clients’ creditworthiness, not yours. In exchange for their services, the loan provider will keep a percentage of the invoices (1-4% generally) as payment.

4. Best Realtor Business Loan for General Purposes: SBA 7(a) Loan

SBA loans for real estate agents (whether they be SBA 7(a) loans or any other variant) are not technically loans. What the SBA (United States Small Business Administration) does is guarantee up to 85% of the loan amount so that lenders take on less of a risk and therefore are more likely to approve small businesses that would otherwise have a very difficult time qualifying for funding.

More specifically, an SBA 7(a) loan can be used for essentially any business-related expense, from stocking up on office supplies to refinancing existing debt and anything in between. As far as small business loans for realtors go, SBA loans for real estate agents are among the most flexible and most accessible (though not the fastest business loans, as it will take at least 2 weeks to receive funds).

5. Best Realtor Business Loan for Office Equipment: Equipment Financing

In order to keep your real estate agency working up-to-par in this age of digital technology, you’ll need to have modern computers and smartphones to stay in touch with clients (and portable chargers to keep them juiced!), a drone to provide potential buyers with a virtual tour, a security system to maintain an office space safe from intruders, and so on.

Oftentimes those tools and machines will cost a pretty penny, and that’s where equipment financing comes in as one of the best types of funding for real estate agents. The best part is that the equipment will serve as its own collateral, meaning if you fail to repay the loan you won’t be at risk of losing the assets that you already possessed.

How to Use a Small Business Loan for Real Estate Agencies

The ways to use small business loans for real estate agents are only limited by the imagination of the realtor. Depending on where they’re located, what their competition is up to, which parts of the agency need improvement, etc., the way that one realtor uses a small business loan may be completely different from how another realtor uses a boost to their finances. Below, we list a handful of the more popular ways that small business loans for realtors are used.

Top ways to use funding for real estate agents:

- Scale up an existing business

- Purchase new or used equipment

- Open an agency

- Fund a marketing campaign (including social media marketing)

- Boost cash flow in the off-season

- Stock up on office inventory

- Recover from a business disaster

- Renovate the office

- Cover unpaid client invoices

- Finance a business vehicle

How to Apply for Small Business Loans for Realtors

Become is revolutionizing the business lending process with its proprietary LendingScore™ and Matchscore™ technologies. How? We’re glad you asked!

First off, by filling out one quick and easy online application through Become, business owners are free from the task of completing a separate application for each and every loan provider (and the harm to their credit score that comes along the way). That single application automatically gets sent to dozens of the country’s top lenders with no extra effort from business owners.

Secondly, Become analyzes businesses from top-to-bottom by taking a wide variety of factors into account. The assessment of each ‘funding factor’ comes together in the form of a score out of 100 which represents a business’s likelihood of getting funded - this is what the LendingScore™ is. But it doesn’t end there.

Thirdly, Become provides business owners with transparency that they simply won’t find elsewhere. Typically, a business that is denied funding will not be informed of the reason why it was rejected. In contrast, whether a business qualifies or not, Become goes the extra mile to give business owners insight into which factors they need to improve in order to qualify for more and better funding options.

Fourth, and lastly, the Matchscore™ technology pairs business owners with the optimal loan provider to fit their unique business profile and funding needs. Become has virtually eliminated the need for businesses to spend immense amounts of time sifting through tons of questionable lenders.

Don’t waste any more time - Become has the solutions you need to improve your business funding odds!

Step-by-step guide to applying for small business loans for realtors:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates – if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Don’t think funding for real estate agents is the right option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!