Trusted Partners

What is a Business Line of Credit?

A business line of credit is a type of business financing that allows funds to be used on an as-needed basis and up to a specified limit.

Unlike term loans that provide a lump-sum of money to a borrower, a small business line of credit doesn’t place business owners under pressure to use all of the funds available. The money is there when you need it, to be used however you want.

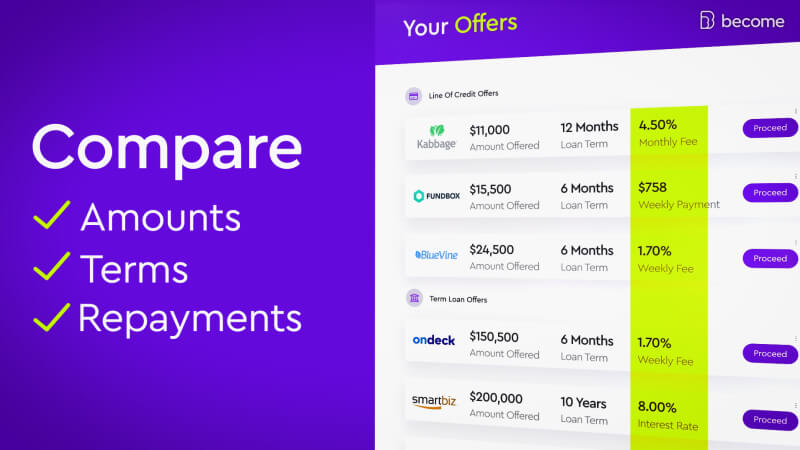

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

More About Business Lines of Credit

Since the funds available with a small business line of credit are typically less than those of a term loan, a line of credit is usually used for more immediate expenses and not for making long-term investments.

Important note: The best business line of credit terms and conditions are made available to those businesses that have higher credit scores, higher monthly revenues, and have been in operation for more time. It takes effort, but you can improve your eligibility for business financing by focusing on the factors that have the biggest impact.

Types of Business Line of Credit

Business lines of credit come in two general categories:

1. Revolving business lines of credit - means that the line replenishes after withdrawals are repaid; for larger businesses that have strong credit scores; credit limits are generally higher

2. Non-revolving business lines of credit - means that the line doesn't replenish; for smaller businesses that have weaker credit scores; credit limits are generally lower

3. Secured business lines of credit - a line of credit which is backed by a valuable asset (collateral) such as real estate, a vehicle, accounts receivable, equipment, or inventory

4. Unsecured business lines of credit - a line of credit that doesn't require the borrower to provide collateral, but usually has higher interest rates and stricter qualifications

More About Secured Lines of Credit

The general idea of a secured business line of credit is that a lender will put a lien against one of your assets. They’re also known as asset-based lines of credit because if you default, the asset used as collateral can be seized by the lender. Yes, you’ll be taking on the risk, but the difference is you’ll usually get higher credit limits and lower interest rates when compared with unsecured business lines of credit.

There are several kinds of secured lines of credit, which differ based on the security that is put forward by the business owner. One of the more common types is a home equity line of credit, or HELOC, where (as the name suggests) your home is used as collateral. But there are other types of secured lines of credit that are designed more for the needs of small business owners.

For example, an equipment-backed line of credit (a sub-type of equipment financing) is a business line of credit that puts a lien on a valuable piece of equipment belonging to the business. Since many small businesses rely heavily on having the right equipment to get the job done, it’s important that you carefully consider the risks involved in equipment-backed lines of credit before moving forward.

Another type of secured line of credit is an invoice-backed line of credit (a sub-type of invoice factoring). The idea is that a lender provides around 80% of your unpaid invoices so that you can free-up that cash and keep your business’s operations running up to par. While this can be a very useful tool, ultimately you’ll want to come up with a stronger strategy for dealing with non-paying customers so that unpaid invoices don’t continue to drag on your cash flow.

Asset-based lines of credit may also be secured with inventory or other valuable properties you own such as a car.

More About Unsecured Lines of Credit

An unsecured business line of credit works very similarly to a credit card. The lender takes on more of a risk than you do since there’s no collateral for them to seize if you default. That heightened risk on the lender’s part results in a few key differences from secured business lines of credit, including:

- Higher interest rates

- Shorter lines of credit

- More difficulty qualifying

How Much Will a Business Line of Credit Cost You?

It’s important to note that with a business line of credit, you’ll only pay interest on the amount that you borrow. If you’re approved for a credit line of $15,000 and you withdraw $2,000, you only have to pay interest on $2,000. That’s a great advantage compared to lump-sum loans which require you to pay interest on the total loan amount regardless of whether or not you put the funds to use.

Let’s continue with that example and calculate how much you’d really pay on that $2,000 withdrawal. To keep this example simple, we’ll assume that you use your line of credit for regularly scheduled payments that give you an average daily balance of $2,000.

We’ll also assume that the interest rate on that line of credit is 11%, and the payments are made weekly. We first take 11% APR and divide it by 365 days in the year, which gives us roughly 0.0301% interest daily. To calculate the weekly interest you’d pay on a $2,000 withdrawal we’d multiply the amount by the daily interest rate, and then multiply that amount by 7.

If the payments were made monthly, then we’d multiply the daily interest by the number of days in the month.

Not a bad deal, but you still need to be careful not to overspend just because the funds are available. Borrowing responsibly is always a must - after all, this is your business at stake!

Top 5 Benefits of Business Lines of Credit:

- Use funds as-needed

- Quick application process

- Low credit scores can still qualify

- Funds replenish; no need to reapply

- Young businesses can still qualify

Although lines of credit come in a variety of forms, the common trait between them all is the ability for borrowers to use the available funds on an as-needed basis. Flexibility is the main advantage of a small business line of credit, which in turn allows for even very young businesses as well as those with poor credit scores to obtain this form of funding. Business line of credit for new business? No problem!

Pros and Cons of Business Line of Credit

|

Pros |

Cons |

|

✔ Use the funds on an as-needed basis ✔ Fast and easy application process ✔ Ability to use funds for any purpose |

? Penalties for late payments can be costly ? Risk of overspending ? Irresponsible use can harm credit |

How Business Lines of Credit Work

Every business has different needs and a different LendingScore™, which means the available types of small business lines of credit will be different from one business to the next.

Line of credit terms can vary from around 3 months to up to 5 years. The payback schedule will vary also - some lenders will ask for monthly payments, others weekly, bi-weekly or even daily. Businesses can also choose between an unsecured business line of credit and a secured line of credit, the difference being whether or not the business owner has to provide collateral. An unsecured line of credit is one of the best financing solutions for young businesses, but you'll have to demonstrate your reliability as a borrower in order to qualify.

The credit limit and the business line of credit rates will also depend on your LendingScore™, as score ranging between 0 and 100 which is calculated based on several ‘funding factors’ such as your monthly revenue, business financials, credit score, business age and more. A better LendingScore™ means you'll have a higher likelihood of getting approved for business financing.

Bottom line: The terms and conditions of a line of credit depend on a variety of different factors. To find out if you can qualify for a business line of credit and to check your LendingScore™ for free, apply here.

Who can benefit from a small business line of credit?

While businesses of all types will find a line of credit as a useful financing option, some businesses stand to gain more, for example:

✔ Businesses that don’t have assets to use as collateral (unsecured business line of credit)

✔ Businesses that need fast funding

✔ Businesses with low credit scores (300+ FICO score minimum)

✔ Businesses that want a flexible funding solution

✔ Businesses that have operated for as little as 3 months

Credit Score Requirements for a Business Line of Credit

In plain language, the credit score requirement for a business line of credit will vary greatly between different loan providers. At Become we are able to help business owners with credit scores as low as 300 (FICO) to qualify for a business line of credit.

Become goes above-and-beyond to provide business owners with the best possible chance of getting funded. By using advanced algorithms, Become is able to quickly and accurately assess a business’s financial profile. And by partnering up with dozens of the top loan providers in the USA and Australia, Become is able to connect businesses with the lenders that are the optimal match for their profile and needs.

Don’t have a perfect credit score? Don’t worry!

Since dozens of loan providers translates to a wide range of different products and services, Become is able to tailor-fit businesses to the loans that are right for them. This also means that the terms and conditions (as well as business line of credit rates) will differ from lender to lender. Business lines of credit offered by the lenders in the Become network have FICO credit score requirements that can dip as low as 300!

This means that businesses with less-than-impressive credit histories are still capable of obtaining the financing they need (or want!). But don’t forget that businesses with a better credit history will receive the best business line of credit terms since they’re seen as less risky. The bottom line is, the credit limit and term length will come down to the level of risk the lender is willing to take.

Step-by-step Guide for Applying for a Business Line of Credit

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

(your credit score won’t be affected!)

Don’t think a business line of credit is the right funding solution for you?

Still have questions? Our representatives are happy to chat - contact us here.