Trusted Partners

What is Commercial Equipment Financing?

Small business equipment loans are a specific type of business funding intended to assist in covering the costs of buying or leasing machines or tools used for professional purposes.

Unlike other types of business loans, business equipment loans often do not require the applicant to secure the loan with valuable assets, since the machinery typically acts as its own collateral.

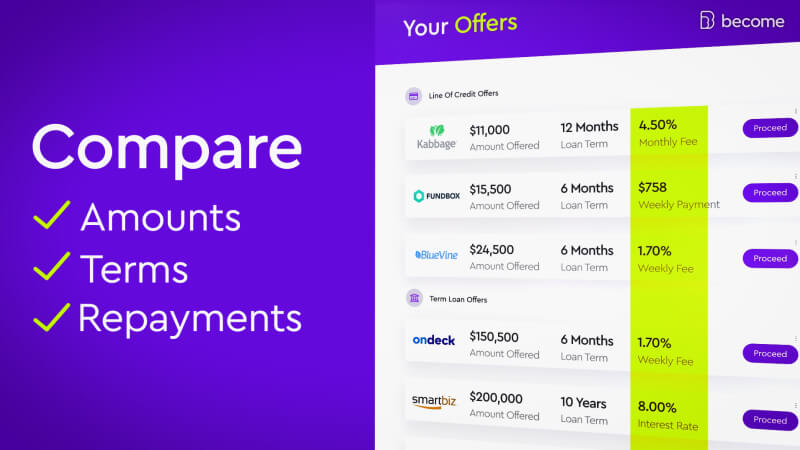

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

More About Business Equipment Financing

Whether you’re considering purchasing or leasing equipment for your company, a business equipment loan provides the flexibility that business owners need in order to obtain the optimal financing solution for them.

Business Equipment Loan Rates

Important note: Lenders will take a careful look over your business’s financial profile before approving a loan. Companies that have stronger credit scores, higher monthly revenues, less existing debt, and so on, will have access to better equipment loan rates.

Basic points to consider when applying for business equipment financing:

- Whether purchasing or leasing is better

- The devaluation rate of the equipment

Top 5 Benefits of Business Equipment Loans:

- Use it to purchase or lease

- Low credit scores may still qualify

- Equipment acts as its own collateral

- Quick application process

- Young business may still qualify

Business equipment financing can be used for virtually any piece of machinery that is intended to be used in practically any industry. Perhaps you want to revamp the kitchen in your restaurant, maybe you need a new air compressor for your dental practice, or you could be thinking about leasing a cement mixer for your construction business. Whatever the purpose is, small business equipment loans can help you meet your expenses.

Pros and Cons of Business Equipment Financing

|

Pros |

Cons |

|

✔ No additional collateral necessary ✔ Easy to qualify ✔ Fast access to funds |

? Equipment devalues quickly ? Often requires a down payment ? Still incurs some interest |

How Commercial Equipment Loans Work

Each business owner that is preparing to apply for an equipment loan will have different needs and a different LendingScore™. A business’s LendingScore™ is a cumulative score that reflects the chances of getting approved for funding; the different factors that are measured include a business’s age, credit score, monthly revenue, existing debt, and many more.

Fortunately, Become has dozens of the top lending partners in its network from all across the USA and Australia, each of which offers different products and has different requirements to qualify. With Become’s unique Matchscore™ technology, businesses are paired together with the loan providers that are the optimal fit for their needs and financial profile.

That means when businesses apply for equipment financing through Become, they have the benefit of having a wide selection of loan options that they may qualify for. Small business equipment loan terms can range from 7 months to 10 years. Equipment loan repayments are generally made monthly, but some loan providers do have weekly or bi-weekly repayment schedules. Plus, business equipment loans generally don’t require any collateral in order to qualify.

Bottom line: Businesses that have stronger funding factors (credit score, business age, monthly revenue, etc.) will ultimately have access to better equipment financing options than businesses that have weaker funding factors. That’s one of the reasons why LendingScore™ is such a helpful tool for business owners seeking to obtain equipment loans, since it also illustrates to applicants how they can improve the specific factors that are holding them back from getting funded!

Who can benefit from business equipment loans?

Simply put, any company that wants or needs a new piece of equipment in order to improve or grow can make good use of equipment financing. Though businesses that have certain traits have even more reason to use equipment loans, including:

✔ Businesses that aren’t able to provide collateral

✔ Businesses looking for fast access to funding

✔ Businesses in need of flexible equipment financing options

Credit Score Requirements for Business Equipment Loans

Across all of the loan providers available through Become, the minimum credit score requirement for business equipment financing is 450 (FICO). That being said, there isn’t any ‘one-size-fits-all’ answer to provide when it comes to the question of credit score requirements.

For business owners who aren’t sure about applying for equipment financing because of a weak credit score, there’s no need to hesitate! If your business has a low credit score, Become has funding solutions that can even help to improve your credit score.

Why Become?

Boost your chances of obtaining business equipment financing with Become! By using advanced algorithms, your business’s financial profile will be quickly and accurately assessed in order to provide tailored guidance on how to improve your funding odds.

No more wishy-washy tips and tricks - get a personalized touch along with a dedicated service that won’t quit until you get funded!

Add to that the fact that lenders compete in order to provide you with the best funding option and it starts to become clear just how helpful Become proves itself to be for small business owners in need of financing.

(the application won’t impact your credit score!)

How to Apply for Business Equipment Financing

Step-by-step guide for applying for business equipment financing:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Don’t think a business equipment loan is the right financing option for you?

Do you still have questions and want to speak with one of our representatives? Feel free to reach out to us and we’d be happy to provide the answers!