Trusted Partners

All About Construction Loans

For many construction companies, it’s only a matter of time before construction business loans or a construction line of credit become a serious consideration. While it is a normal stage in growing your construction business, obtaining finance for construction companies can be a bit difficult for the inexperienced borrower. No worries, that’s what we’re here to help out with.

- What are the different types of construction business financing?

- What are commercial construction loan rates?

- How should you use commercial construction loans?

We cover these questions and much more just below. Find out all there is to know about finance for construction companies so you can make the right funding decision for your business.

In this growing industry, construction business owners and contractors are familiar with just how crucial it is to have access to spare funds at a moment’s notice. When a new project gets put on the table, there are a wide variety of raw materials necessary to get the job done. And depending on demand, construction business owners will be faced with the need to purchase new equipment in order to complete a plan, which of course can come with a heavy price tag.

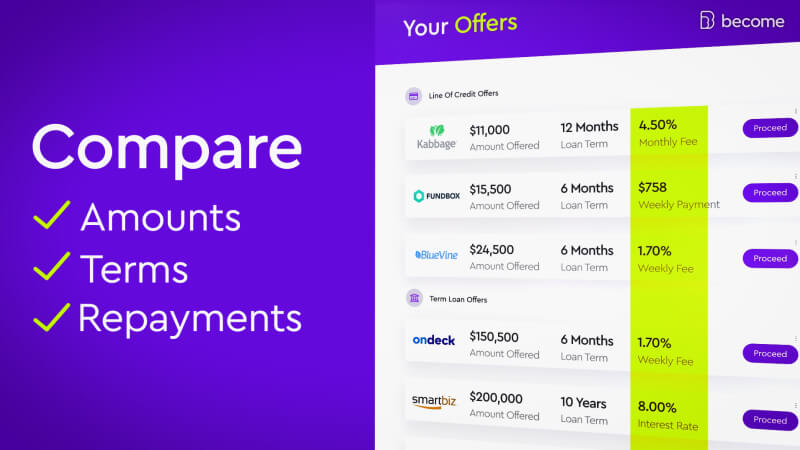

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

Financing Options for Construction Business Loans

Where the Construction Industry Stands:

According to the US Census, the construction industry is composed of nearly 700,000 companies that employ more than 5 million people all across the country. And Statista finds that “In 2017, new construction put in place in the United States was valued at around 1.23 trillion U.S. dollars...and is expected to generate some 1.5 trillion U.S. dollars in revenue by 2022.” While the construction industry took a dip as a result of the 2008 Great Recession, it’s been growing over the past decade and is projected to continue doing so.

Commercial construction loan rates vary depending on the type of construction business financing.

Here you'll learn about the variety of options that exist when considering construction business loans. And those options are even more accessible thanks to the way Become has revolutionized the business lending process with fintech.

Start up Business Loan

If you’re establishing a construction business from scratch, then a start up business loan can be the source of construction business financing needed to get off the ground. Start up business loans are particularly useful if you’ve already got a plan for a construction company, but don’t have the funds to make your dream into reality.

To qualify for this type of loan your business doesn’t need to be in business long, which presents a great advantage for people aiming to become construction business owners.

Qualifications & Features

- Credit score of 680+ for FICO

- Preferably 3 months in business

- Rates as low as 0%

- No monthly revenue required (yes, you can have a revenue of $0 and still qualify!)

- Construction loans from $3,500 to $250,000

- Monthly repayment schedule

Business Line of Credit

Construction businesses are in an industry prone to changes. As such, a construction business owner may rely on a construction line of credit that gives their company the ability to borrow as much as needed (up to a set amount). A business line of credit is generally treated as a backup plan, giving your business emergency access to funds when you need them most.

The credit limit for your business is based on the market value, profitability, and risk taken on by your construction company - all of which are determined by the loan provider. Construction line of credit is very similar to business credit cards.

Qualifications & Features

- Basic requirements to qualify:

- Do not exceed the credit limit

- Meet monthly minimum payments

- Time in business: 3 months minimum

- Minimum monthly revenue: $5,000

- Interest rates vary according to factors designated by the lender (1%-10%)

- Repayment schedule is pre-arranged directly with the lender

Equipment Finance

A construction company’s ability to conduct business and maintain a high quality of service depends on the equipment that it uses. Whether it’s something small like a table saw to cut support beams accurately, or a heavier piece of machinery such as a jackhammer to tear up an old driveway - the final outcome of your construction work will rely largely on the equipment you use.

You may be just beginning to piece together your equipment inventory, or perhaps you want to keep your company competitive in the industry; either way, it’s essential to own up-to-date construction tools in order to provide a service that customers will be happy to recommend. Business equipment loans can be used to make the purchases you want (or need) without digging yourself into a hole of debt.

Qualifications & Features

- Construction companies with poor credit scores are often still eligible

- Interest rates range 4-6%

- Repayment over a long period: 2-6 years

- No need to pay assets in full

Unsecured Business Loan

For construction companies that have relatively high credit scores, unsecured small business loans offer some of the best terms available. Unsecured business loans don’t require any form of collateral, which means that the loan provider is taking on the bulk of the risk (good news for business owners). And although qualifying for an unsecured loan is generally more difficult, getting approved for this type means that other small business loans will be easier to obtain.

Qualifications & Features

- Short approval process: 48-72 hours

- Higher interest rates than other forms of finance for construction companies

- Repayment periods tend to be shorter: 3-18 months

SBA Loan

The SBA (U.S. Small Business Administration) provides help to small businesses by covering up to 85% of a business loan amount - including construction business loans. What this really means is that your construction business can get financed despite the fact that you may not feel certain that you’ll be able to repay the loan.

Although SBA loans don’t provide the funding itself, they do provide security to borrowers (which also serves as security for lenders, and gives them more of an incentive to approve applications for construction business loans). Construction financing can be used for anything from purchasing new construction equipment to advertisement.

Qualifications & Features

- Minimum credit score of 500 for FICO

- Ideal time in business: 2 years

- Interest rates as low as 6.5%

- Minimum monthly revenue: $0

- Loans from $30,000 to $5,000,000

- Monthly repayment schedule

- Payback periods range 5 - 25 years

Merchant Cash Advance

Looking for a quick short-term fix to your construction business financing? A cash advance may be a useful answer. This method of construction business funding is recommended as a last-case scenario if you’re faced with a particularly demanding billing cycle and need a quick solution.

When your concrete mixer decides to quit on you without any forewarning, or when you have unpaid invoices and can’t make rent, merchant cash advances can get you out of a jam. Generally speaking, your credit score will determine the amount your business is qualified to receive in the form of a cash advance.

Qualifications & Features

- Minimum credit score: 500 for FICO

- Minimum time in business: 6 months

- Minimum monthly revenue: $10,000

- Repayment is done automatically by drawing from future debit and credit-card transactions

- Payment period lasts as long as it takes for the full amount to be repaid

Step-by-step Guide for Applying for Business Construction Loans:

1. Complete application - simply answer a few simple questions including:

- Select your loan amount

- Enter your business age

- Enter your credit score

- Enter your monthly revenue

- Select your industry (construction)

2. Link your business bank account/manually upload statements - this is necessary so that lenders can analyze the health of your business so that you can get a loan best matched to your financial status and needs.

3. Receive business loan offers - you can receive offers and funds in your account in as little as 3 hours!

4. Improve your LendingScore™ (to improve your fundability and offers) - this step is unique to Become. You’ll receive a tailored funding dashboard whereby you can learn all of the funding factors that affect your funding odds. You’ll be given a step-by-step breakdown of how to improve each factor, thus improving your LendingScore™, and receive more (and better) loan offers.

Is it Difficult for Construction Businesses to Get Loans?

Commercial construction loans can be quite difficult to get approved through traditional banks. The process of getting a loan through a bank is littered with bureaucratic hurdles to clear and becomes way too time-consuming. Plus, every time you apply for a loan through a bank, your credit score is negatively affected.

That’s where Become steps into the equation! With advanced algorithms and the LendingScore™ dashboard that provides tailored guidance, Become help companies of all ages and sizes get funded. By breaking the norms of the traditional loan application process Become improves the chances of obtaining business loans for construction companies.

Benefits of applying via Become:

- Simplify the steps involved

- Speed the process - funding in as little as 3 hours!

- Your credit score will not be harmed

What’s the trick to improving the chances of obtaining finance for construction companies? First, there are a handful of important mistakes that should be checked for, and handled, before applying for construction business financing.

The top 5 reasons why business loans get rejected are:

- Bad credit - if your credit score is too low, it will raise concerns among lenders that you may not be a reliable borrower. Be sure to make payments on time and limit your debt utilization (more just below).

- Misuse of debt utilization - the target should be to use around 30% of your credit. For example, if your credit line is $5,000 you should aim to only put around $1,500 in order to maintain a healthy credit history.

- Business is too young - unfortunately for companies less than a year old, youth is not a virtue when it comes to loan applications. Even if other factors like credit score and revenue are up to par, newer companies are still at risk of getting denied. This isn’t a ‘mistake’, but there are solutions other than waiting for time to pass.

- Revenue is lacking - if your construction company isn’t making a lot of money yet, it’s a red flag to lenders that you may not be able to pay back the loan.

The remedy to weak revenue is:

- Reduce spending where possible

- Find effective methods of collecting outstanding invoices

- Have a plan to help boost your cash flow in times of drought

- Applied with the wrong lender - there’s a wide variety of loan options and loan providers to choose from. Without proper advice, it’s possible to apply with a lender that doesn’t fit your construction company’s financial profile.

What Can Construction Companies Use Business Loans For?

The ways in which commercial construction loans can be used are limitless - but there are a few that tend to be most popular among construction business owners.

Here are a few prime examples of how to use your construction business financing:

- Cover unexpected expenses - whether it’s unpaid invoices from non-paying customers, a lawsuit, recovering the business after a natural disaster, or worker’s compensation, the construction industry can throw you a curveball without warning. Use construction business loans as a way to handle unforeseen financial obstacles.

- Finance projects - if your aim is to scale up your business, then you’ll naturally want to take on bigger projects. That could mean the expenses involved are beyond your current budget, in which case commercial construction loans can be a practical solution.

- Hire/train employees - you wanted to go into the construction business to make money, but not to necessarily do all of the work on your own. Adding members to your team will help your business provide quality service, and business loans for construction companies can make it easier to hire that professional help.

- Purchase materials and/or equipment - successful construction companies rely on up-to-date equipment. You may want to buy new, or save some money and buy used, but in either case construction business financing will take some of the weight off your shoulders. Also, be sure to consider the differences between equipment loans and equipment leasing before making a decision.

- Outsource - while construction is your profession, you may need help when it comes to accounting, marketing, or developing an online presence (to name a few). While those services will ultimately help you make and save more money, they, of course, come at a price. Use construction business loans to make outsourcing more affordable.

- Establish or expand brick-and-mortar headquarters - an online presence is certainly important to have, but since a construction business is all about building physical structures then it may be a good idea to have a physical location. Business loans for construction companies can be used for this as well.

How to Get Loans for a Construction Business

Step-by-step guide for applying for construction business loans:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Why Apply for Construction Loans with Become?

Having trouble obtaining finance for construction companies?

Looking for the best commercial construction loan rates?

If you answered yes, then you're in the right place...

Become works hard to improve your chances of getting approved for construction business financing. But it’s not just about improving funding odds - Become helps to unlock better funding opportunities and provides construction businesses with their optimal funding solution.

How does Become help with getting approved for commercial construction loans?

First, a large variety of factors (including business age, financial status, business credit, and more) are gathered and taken into consideration by advanced algorithms to determine how well your business is doing.

Second, you’ll find out which of the dozens of lending partners you may qualify with. In the event that your business doesn’t qualify, then you’ll be given guidance on how to increase your funding chances.

A step-by-step improvement plan is outlined on the interactive LendingScore™ dashboard. This technology nurtures businesses throughout the funding cycle by providing a tailored financial profile. The truly unique aspect of Become is that it provides that personalized financial advice at no fee.

Discover which construction business loans you may qualify for

Don’t think construction business loans are the right option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!