Using Become's services is entirely free of charge. Please be aware that our lending partners offer a range of business loan products, and interest rates and APR may differ among lenders. Rates will also depend on your individual qualifications.

All About General Contractor Loans

The contractor industry - commonly referred to as the ‘gig economy’ - is one part of the modern American economy that has been raising lots of eyebrows over recent years. Whether the interest in the independent contractor economy is due to sector growth or to new forms of self-promotion (social media marketing, for example) is still up for debate, but the raw numbers still have a lot to say.

According to the Bureau of Labor Statistics, independent contractors make up roughly 6.9% of the workforce in the USA, or 10.6 million American workers. To put that in perspective, there are more contractors than there are real estate agents, dentists, and trucking employees in America combined! Despite its size though, the independent contractor economy presents a number of challenges. Among those obstacles is the difficulty of obtaining business loans for contractors.

Access to capital is critical for the continued success of any and every contractor, regardless of their line of work. Fortunately, there are multiple forms of general contractor loans, and each is designed to fulfill a different purpose. If it’s a piece of machinery or equipment that needs replacing, if customers don’t pay on time, or for general operational costs - contractor business loans can be the lifeline that keeps a contractor’s business going.

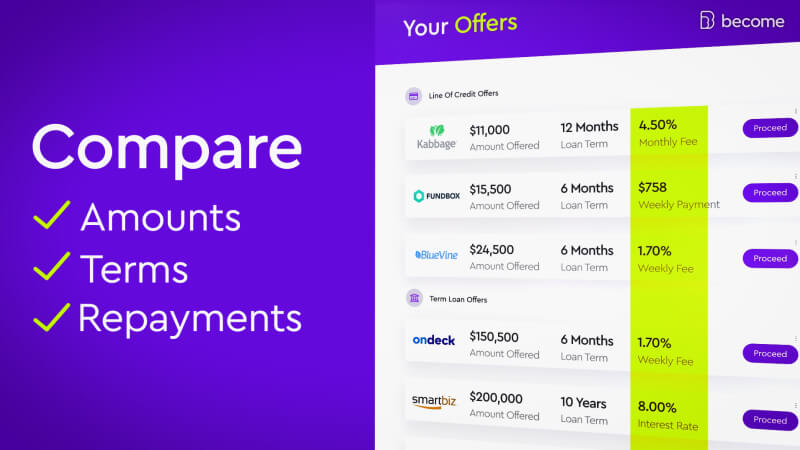

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

Best Business Loan Options for Contractors

Unsecured Business Loan

An unsecured business loan is a type of contractor business loan that doesn’t require any collateral. In other words, your personal assets won’t be placed at risk when dealing with unsecured business loans. In exchange for that convenience, the interest rates tend to be relatively higher compared to other forms of loans for contractors. But, unsecured business loans offer flexibility to independent contractors, as they can be used for essentially any business-related expense.

Qualifications:

- Minimum time in business: 6 months

- Minimum monthly revenue: $10,000

- Minimum credit score: 450 (FICO)

- Interest rates: Start at 7.5%

Business Line of Credit

A business line of credit is something that every independent contractor is encouraged to have. It’s comparable to a credit card, where the funds can be used on an as-needed basis. A line of credit presents a contractor with the advantage of not facing any penalty or charge if the funds are not used - which isn’t the case for many other general contractor loans. If you’re looking for business loans for contractors that can be used as a financial backup plan, then business lines of credit may be the solution for you.

Qualifications:

- Minimum time in business: 3 months

- Minimum monthly revenue: $4,200

- Minimum credit score: 450 (FICO)

- Repayments: Monthly, typically automated

SBA Loan

The Small Business Administration (SBA) doesn’t actually provide the funds but instead gives lenders a guarantee of up to 85% of the loan amount so that they (the lenders) take on less of a risk. That also raises the odds that small businesses will be approved by the lender. Of all the contractor business loans out there, SBA loans are among the best not only because of the safety net that the SBA provides but also because of the flexible uses for SBA loans.

But, since the terms and conditions of SBA loans are so attractive to small business owners, the demand for them is higher. Business owners like them so much that you can even take multiple SBA loans out simultaneously.

Qualifications:

- Minimum time in business: 3 months

- Minimum monthly revenue: $5,000

- Minimum credit score: 500 (FICO)

- Loan term: Up to 10 years

Equipment Financing

Many if not most independent contractors rely to some degree on machines or equipment in order to get their work done. Whether they work in construction, auto repair, manufacturing, or any other line of practice, equipment financing loans for contractors can truly come in handy. They can be used for purchasing new or used equipment, or even to repair a damaged piece of machinery.

Qualifications:

- Minimum time in business: 3 months

- Minimum monthly revenue: $5,000

- Minimum credit score: 450 (FICO)

- Loan term: Up to 10 years

Invoice Factoring

When customers aren’t paying on time and unpaid invoices begin piling up, invoice factoring can be the ideal type of business loan for contractors. This sort of general contractor loan provides contractors a percentage of the total amount due (generally 80%) upfront and then pays contractors the remaining amount after having collected from their clients (keeping usually between 1% and 4% for themselves as payment for the service).

Independent contractors should be even more careful about non-paying customers than the typical business owner, which makes invoice factoring an even more useful financial solution for contractors.

Qualifications:

- Minimum time in business: 3 months

- Minimum monthly revenue: $5,000

- Minimum credit score: 500 (FICO)

- Loan term: Up to 6 months

What Can You Use a Contractor Loan For?

The possible uses for general contractor loans are virtually endless. As mentioned, the specific intended use for contractor financing should be considered when choosing which type of contractor business loans to apply for.

Here’s a glance at just a few examples of how business loans for contractors can be used:

- Generate contractor leads with marketing

- Keep cash flowing in the offseason

- Purchase a business vehicle

- Build a home office

- Replace equipment

- Recover after a business disaster

3 Tips for Qualifying for a Contractor Loan

Successfully qualifying for contractor business loans depends on a variety of factors, including the type of loan being applied for, the amount being applied for, and the overall financial health of the independent contractor in question just to name a few. Financial health is determined by assessing several ‘sub’-factors which include the contractor’s credit score, how long they’ve been in business, their monthly revenue, and many more.

Why do lenders look at so many different factors when considering whether to approve or reject business loans for contractors? To put it plainly, lenders want to weigh the risk that they’ll be taking on when loaning out money. In order to do that, they make the best determination they can about a contractor’s ability to repay a loan by looking at those factors..

If some of this comes as news to you, don’t feel bad. Traditional lending institutions aren’t known for giving business owners the ‘full picture’ when it comes to the loan approval process. There’s even a fair amount of alternative business lenders who keep the cards close to their chest when dealing with potential borrowers.

Become does things differently. With advanced algorithms, Become provides business owners with a level of transparency that they simply won’t find anywhere else. Get started off right with the following three quick tips to qualify for contractor business loans.

1. LendingScore™

LendingScore™ is the proprietary technology designed and developed by Become which has revolutionized the business lending process. LendingScore™ analyzes a business’s financial profile top-to-bottom and then assigns a score between 0 and 100 which represents the business’s likelihood of receiving funding (the higher the score, the better the fundability). By using a visual representation of a business’s chances of getting funded, business owners are able to more clearly understand exactly where they stand in their efforts to get a loan.

That’s just the start.

Each business owner then gets access to their own tailored LendingScore™ Dashboard which gives exclusive insights into the funding factors that need improvement, and how much each factor is impacting the business’s fundability.

The cherry on top of LendingScore™ is that it is available at absolutely no cost to business owners. All you need to do is complete the fast and easy online application through Become and you can start taking your funding chances into your own hands!

2. Use Tax Filing Software

Independent contractors may have it easier when it comes to keeping records since they don’t have employees, nut they’ll still have to keep track of the work they do for tax season. Thankfully, in our day and age of digital technology, there are online services that business owners can use to simplify the process of filing taxes.

There are several tax filing software available to choose from - it’s less important which one you pick and more important that you keep accurate records of your business transactions to the best of your ability. Save yourself the headache during tax season and stay on top of the ball year-round!

3. Improve Your Credit Score

This tip to for qualifying for contractor business loans may seem obvious to you, but it’s worth the reminder. Your personal and business credit score (yes, there are two) will be one of the primary factors that loan providers check when choosing whether or not to approve a business loan application. There are lots of ways you can improve your credit score, including using credit cards wisely and responsibly.

That said, credit scores are not the last word (or number) when determining eligibility for business loans, including general contractor loans.

Step-by-step Guide for Applying for a Contractor Loan:

Step-by-step guide to applying for contractor business loans:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates – if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Don’t think general contractor loans are the right option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!