Trusted Partners

What are SBA Loans?

Small Business Administration loans (SBA loans for short) are a type of commercial financing designed to increase the odds of a small business obtaining funding by reducing the risk taken on by the loan provider.

Technically SBA small business loans are not actually loans. Instead, SBA financing provides a guarantee of up to 85% of the loan amount. What that does is minimize the amount of risk lenders take on, which makes them more likely to approve small business loan applications.

Concerned that SBA loan rates are too high? SBA loans actually have some of the lowest rates, making them one of the smartest ways to finance your business - it's no wonder so many small businesses apply for them each year!

With the right information and preparation, you could secure some of the lowest business financing available to business owners.

Worried about the SBA loan application process? While it can seem like a daunting task for the inexperienced borrower, the online SBA loan application through Become is quick and stress-free and allows you to compare offers from multiple lenders. If you don't qualify for an SBA loan, there are many other more accessible ways to get a business loan.

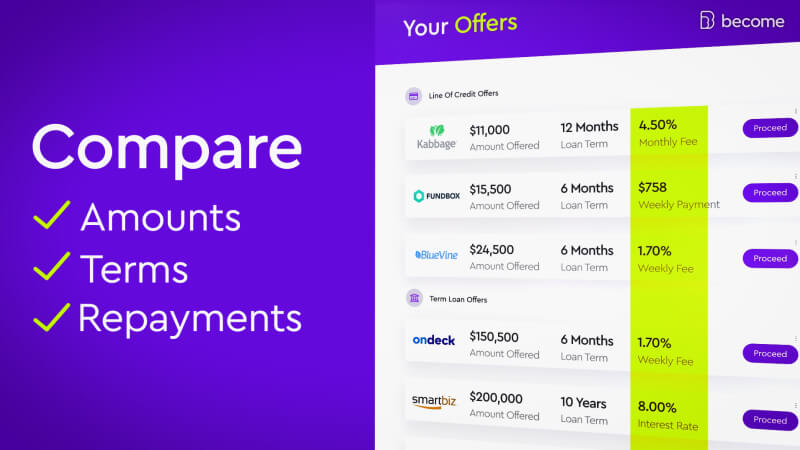

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

More About SBA Financing

Since 1953, government small business loans have been helping business owners obtain the funding they need while simultaneously offering loan providers a safety net. The downstream effect of Small Business Administration loans has been immense growth in the small business sector.

According to the SBA, 99.9% of employer firms in the United States are considered small businesses (employing fewer than 500 employees).

Basic points to consider when applying for SBA business loans:

- The SBA is a risk reducer for loan providers, not a business loan provider itself

- SBA business loans can range $500-$5.5 million

How to Qualify for an SBA Loan

If you want to apply for SBA loans, you'll need to meet certain minimal requirements. Those criteria vary depending on your business's financial profile as well as the type of SBA loan you're applying for.

In general, the minimum requirement to qualify for SBA loans are as follows:

- Down-payment of between 20% and 30%

- A business plan to provide the lender

- Written guarantee to be responsible for the payments

- Majority ownership by U.S. citizen(s)

What are SBA Loans Requirements?

Apart from the variable qualification criteria, the basic SBA loan requirements outlined by the Small Business Administration are that...

- the business is for-profit,

- the business operates in the United States,

- the business owner must have invested their own time or money,

- and that all other business financing options have been tried without success.

What Documents Will You Need to Apply for SBA Loans?

Although certain lenders may ask for additional information about your business in order to apply for SBA funding, all lending institutions will require you to submit the following documents:

- Personal and business tax returns

Most loan providers will require income tax returns for the preceding 2 years minimum.

- Bank statements (PDF format)

A scan of your bank statements going back 3 months - make sure these are the official and complete statements from your bank (including recent month to date transactions).

- Year-to-date balance sheet

Provide a financial statement summarizing your business assets and liabilities.

- Year-to-date profit & loss

Provide a financial statement summarizing your revenues and expenses since your last filed tax return.

- Business debt schedule

Your business-related debt, including any loans, leases, contracts, accounts payable, and any other miscellaneous payables.

SBA Loans: Quick Facts*

*Note: these figures are the minimum figures across all of Become's lending partners.

Top Benefits of SBA Lending:

- Many SBA loans include ongoing business support

- Competitive interest rates

- Low down payments

- Poor credit scores may still qualify

- Quick application process

There are no limits to the ways in which a small business may choose to use SBA financing. Whether you spend government small business loans on hiring more employees, purchasing new equipment, or opening up a second location - SBA business loans make it easier to get the funding needed to improve your company.

(*Applying will NOT harm your credit score!)

Pros and Cons of SBA Business Loans

|

Pros |

Cons |

|

✔ Risk mitigation ✔ Longer payment periods ✔ Lower interest rates |

? Can require collateral ? Difficult for startups to qualify |

How do SBA Loans Work?

By covering up to 85% of the loan amount, the Small Business Administration creates a business lending environment where both businesses and loan providers have the advantage of more favorable terms. SBA loans improve the business lending process in two key ways:

- SBA guaranteed loans make business owners more comfortable with borrowing funds that they would likely otherwise be hesitant to borrow.

- SBA guaranteed loans make loan providers more confident in lending funds to small businesses that they would likely otherwise feel are too risky to lend to.

But the odds of getting approved for SBA funding is like hitting the lottery, right? Not quite.

Business owners who apply for SBA loans through Become have the privilege of extra advantages thanks to advanced algorithms which make the business lending process simpler, quicker, and more likely to result in approval.

Plus, with the proprietary Matchscore™ technology, Become efficiently and accurately matches business owners with the lenders that are the most optimal fit to their business financial profile and requirements.

How Long Does it Take to Get SBA Loans?

The average wait time for a business to obtain SBA funding is roughly two-to-three months. That's quite a long while to wait when you're in need of financing to keep your business running smoothly.

Fortunately, when businesses apply for SBA loans with Become's online application, the average wait time of two or three months can be cut down to as short as 14 days. Cutting edge technology makes the SBA loan application process more than just easy, it makes the process much faster as well.

SBA Loans: Rates

SBA interest rates will vary depending on the types of SBA loans you're considering applying for.

Generally speaking, SBA interest rates will be based on the prime rate plus an additional percentage which is known as the 'spread'.

Including the current prime rate (5.50%) the range for SBA interest rates will be as low as the prime rate plus 2.25% and as high as the prime rate plus 6.25%.

How to Choose the Right SBA Small Business Loan Program for You

Government small business loans come in two general categories: SBA 7a loans and SBA 504 loans. Generally speaking, an SBA 7a loan is more flexible and is intended for a broader range of business-related financial applications when compared with an SBA 504 loan.

For example, an SBA 7a loan can be used to purchase an existing business, cover the cost of stocking up on inventory, refinance existing debt, or for working capital to keep the everyday functions of the business running smoothly.

On the other hand, an SBA 504 loan (also known as a CDC loan) has more specific applications, namely for purchasing valuable equipment, buying land or buildings, and construction projects.

The chart below provides more details on how SBA 7a loans compare with SBA 504 loans.

| SBA 7(a) Loan | SBA 504 Loan | |

| Loan Uses |

|

|

| Loan Amount |

|

|

| Repayment Periods |

|

|

| Interest Rates |

|

|

Bottom line: Since SBA 504 loans are meant for specific expenses, unless you’re looking to buy real estate or machinery, or finance a large construction undertaking, an SBA 7a loan will likely be the more appropriate funding solution for your small business.

Other Types of SBA Loans

- SBA Express Loans - responses within 36 hours, but has higher interest rates and lower guarantee amounts (max 50% guaranteed by SBA)

- SBA Advantage Loans - Community Advantage Loans that help businesses with difficulty qualifying for the standard SBA 7a loan

- SBA CAPLines - line of credit financing designed to help businesses that need access to funds on an as-needed basis (SBA CAPLines come in four subtypes)

- SBA Export Loans - designed for businesses that want to either begin or boost exporting operations to foreign markets (SBA Export Loans come in three subtypes)

- SBA Microloans - average loan amounts of $13,000 (max $50,000), but the SBA doesn’t guarantee any percentage under the Microloan category

- SBA Disaster Loans - only companies that need business disaster recovery assistance can qualify, but the funds can be used for a wide variety of purposes

The SBA Loan Application Process

After you've gone through the different types of SBA loans and chosen which one is the best fit for your business's specific needs, it's time to take the final step and apply for an SBA loan.

Step-by-step guide for applying for SBA financing:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

“If a company has been in business for at least two years, is profitable and has cash flow to support loan payments, it’s likely a good candidate for an SBA loan,” According to CEO of SmartBiz (SBA loan provider), Evan Singer. So if your business is struggling, an SBA loan isn't going to be the best fit.

Don’t think SBA loans are the right financing option for you?

If you still have questions and want to speak with one of our representatives, please feel free to reach out to us and we’d be happy to provide you with the answers you’re looking for!