Trusted Partners

What is a Business Auto Loan?

A business auto loan is a type of commercial financing that is specifically designed to help cover the costs of purchasing or leasing a business vehicle.

What makes commercial vehicle loans unique is that the automobile that is being purchased itself serves as the collateral for the vehicle financing. That means businesses which lack valuable assets can still qualify for a business auto loan.

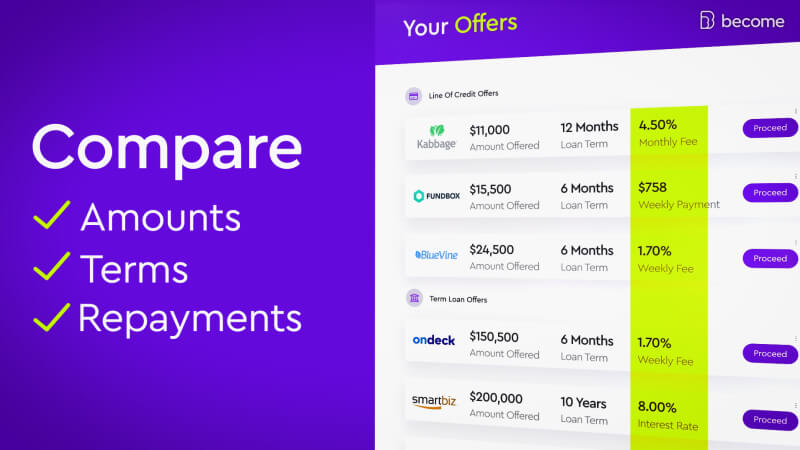

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

More About Business Auto Loans

A commercial car loan can be used to either purchase or lease a new or old automobile, which offers businesses of different ages and in different industries the flexibility to find the right business vehicle finance for them.

Important note: Businesses that have been operating for a longer time, demonstrate higher monthly revenues, and have stronger credit scores, will normally receive offers for business car loans that have better terms and conditions.

Basic points to consider when applying for commercial auto loans:

- What type of vehicle you need

- Your budget for down payment

- The overall cost of purchasing

Top 5 Benefits of Business Vehicle Finance:

- Use it to purchase or lease

- Receive financing for new or old vehicles

- Vehicle functions as its collateral

- Long repayment terms

- Access up to 100% of the cost

Business auto loans can be used for different types of vehicles meant for a variety of purposes. So whether it’s for a truck to carry loads of business equipment, a tractor for tilling land or towing other vehicles, or a humble car to bring you to meet with clients, a commercial vehicle loan can be the funding option that keeps the gears of your business turning smoothly.

Pros and Cons of Business Auto Loans

|

Pros |

Cons |

|

✔ Get up to 100% of the cost covered ✔ No additional collateral necessary ✔ Ability to use funds for different vehicles |

? Automobiles quickly depreciate in value ? May become stuck with obsolete vehicle ? Typically require strong credit score |

How Business Vehicle Finance Works

When businesses apply for vehicle financing through Become, advanced algorithms quickly go to work to determine the different needs that each business has along with the best funding solution for them.

Every business that applies through Become receives tailored guidance on how to improve their LendingScore™, a score which represents the business’s overall fundability. The LendingScore™ reflects a number of factors that each impact a business’s ability to obtain funding, including monthly revenue, existing debt, business age, credit score, and more.

Commercial auto loan terms can range from as low as 18 months up to 10 years. Payment schedules are normally monthly but, depending on factors such as the lender and the business’s financial profile, the payments may also be weekly or bi-weekly. While there’s no need to provide collateral for business car loans, depending on the business’s credit score a personal guarantee may or may not be required in order to secure the financing.

Bottom line: The amount of funding, whether it’s 100% of the cost of the vehicle or a portion of it, will also be a reflection of the lender’s willingness to take a risk. That’s why the LendingScore™ is such a powerful tool for both the business car loan applicant, as well as the vehicle finance provider - it clarifies the improvement process for businesses and simplifies the assessment process for lenders.

Who can benefit from a commercial vehicle loan?

Any business that needs (or wants) to obtain a vehicle in order to improve their business should apply for a commercial auto loan, but certain businesses will find vehicle finance especially useful including:

✔ Businesses that don’t have valuable property to use as collateral

✔ Businesses that need a lengthier time to repay the loan

✔ Businesses in need of financing with lower interest rates

Credit Score Requirements for a Business Vehicle Loans

To cut right to the chase, different loan providers will offer a wide range of differing credit score requirements for business vehicle loans. Businesses with credit scores as low as 450 (FICO) may still be able to qualify for vehicle financing by applying through Become.

Find your way into the fast lane with Become - we’ll help you obtain a commercial vehicle loan the smart way. Become uses cutting-edge algorithms that assess your business’s financial profile with the utmost speed and accuracy. With dozens of the most reputable and experienced loan providers across the United States and Australia in the Become network, your business is matched with only those lenders that are most relevant.

Imperfect credit scores can still qualify!

Businesses that apply for commercial auto loans vary greatly in terms of how long they’ve been operating, what their monthly revenues are, and of course what their credit scores are. It only makes sense then that there is also a wide variety of products and services that loan providers offer, along with different terms and conditions that may apply. With that being the case, business owners who apply for vehicle financing through Become can qualify with FICO credit scores as low as 450!

If you’re aiming to obtain a business auto loan but you’re uncertain about your ability to qualify due to a poor credit score, you shouldn’t be worried. There are still vehicle financing solutions available at your disposal through Become. But of course, if you want to qualify for the best terms, you’ll need to improve your credit score to show lenders that you’re a reliable borrower.

(your credit score is not affected!)

How to Apply and Qualify for a Business Vehicle Loan

Step-by-step guide for applying for a commercial vehicle loan:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

Don’t think a business auto loan is the right funding solution for you?

Do you still have questions and want to speak with one of our representatives? We’re here to provide the answers! Don't hesitate to reach out for help.