Trusted Partners

What Is a Startup Business Loan?

Start up loans are essentially any type of financial solution that are designed for young businesses. It’s important to note that there are differences between startups and small businesses, particularly with regards to the kinds of funding options that are available.

Startup fundraising comes in many forms, including (but not limited to):

-

SBA loans

-

Credit cards

-

Government grants

-

Crowdfunding

-

Investments from family and friends

-

Venture capitalists

It’s crucial that startups have access to capital, since there are so many challenges that can arise in the early stages of establishing a business. That, in addition to the fact that it’s much harder for startups to get approved for business loans from banks, explains why there is a wider variety of loans to start a business than business loans for established and stable companies.

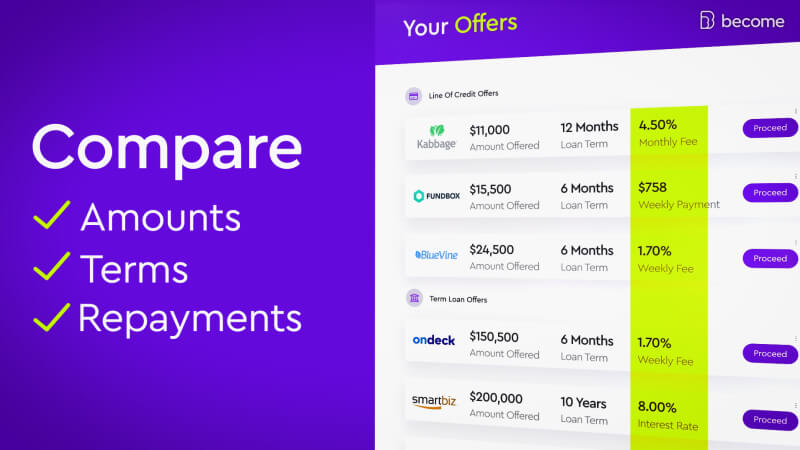

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

More About Startup Loans

The ways that small business start up loans can be used to accelerate growth and improvement are virtually limitless. That said, the five general ways that startup business loans can be applied to boost productivity are for:

- Market penetration - marketing, advertising, and price changes

- Market expansion - exploring new territory and new demographics to expand customer base

- Product expansion - opening new business opportunities by offering new products or upgrading and revamping those that exist

- Diversification - entering a new market or a new industry with a new product

- Acquisition - obtaining 50% or more of another company in order to strengthen your business

Some more specific examples of how startup business loans can be used are to:

- Develop and implement a well thought-out social media marketing strategy

- Embrace new technology trends (in retail, manufacturing, restaurants, etc.)

- Scale up your startup

- Boost your website’s SEO

- Improve customer experience

Regardless of how you go about using business start up funding, you’ll want to get the best terms possible. With dozens of the top lenders from across the country, Become is able to match small businesses (including startups) with the optimal loan provider for their specific financial needs.

The Best Startup Loan Options

Start up loans are designed for businesses that are in their early stages. That can mean businesses that are only just getting started, or those as young as 3-6 months in age. Generally speaking though, lenders prefer businesses with longer operating histories. That said, there are a couple of top lenders in the Become marketplace who do provide financing options for even the youngest of businesses.

Business start up funding from Fundbox typically comes in the form of an SBA loan, though there are a couple of types that they offer which are useful for startups including SBA 7(a) loans and SBA Community Advantage loans. Although most loan providers who work with SBA loans will require at least 2 years in business, certain exceptions are made for businesses that are able to make up for their young age in other ways, such as having very strong credit scores.

There are a number of kinds of business start up funding that Seek Business Capital offers, but the one that is easiest for startups to qualify for in their earliest stages is business credit cards. In fact, as they point out, a small business owner with a strong enough personal credit score can be eligible even if their operating history is non-existent. You’ll essentially be required to prove that your business is registered, that you have a federal tax identification number (EIN), and Articles of Incorporation.

Who Qualifies for a Startup Loan?

While anybody can open up a crowdfunding page or take a personal loan from a family member or friend, business start up funding providers will have tighter requirements for determining eligibility. More specifically, startups that apply for business loans through Become are required to be in business for a minimum of 3 months. It very well may be the case that your startup is still a bit young and will have difficulties getting approved.

If your business hasn’t been around long enough to get loans to start a business through Become, don’t worry. Business owners that don’t qualify right away are still granted free access to their very own tailored LendingScore™ Dashboard.

LendingScore™ uses technology to reveal an easy to understand snapshot of your business when it comes to it’s fundability. Think of it as a far more detailed credit score. You’ll also receive tips, tools, and plenty of articles to help improve your funding odds until you’re successfully matched with an optimal lender.

How to Apply for a Startup Business Loan

Step-by-step guide for applying for a startup business loan:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender and terms

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates – if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

(there's no risk to your credit score)

Other Startup Funding Options

There are a number of startup funding options aside from small business start up loans that are available. Take a look over the variety of alternative financing solutions that startups can make use of below:

Bootstrapping

Bootstrapping is the term used to describe doing something on your own, in this case funding your own business with your personal savings. It certainly comes with its risks, but if you’re able to get through the bootstrapping phase successfully it will show future investors that you’re serious about your business. That will likely influence their decision whether or not to invest or lend you money.

Seed Capital

The same way that a seed must be planted in order for a tree to grow, some funding must be put forward in order to get a business up-and-running. Those first few sources of financing are collectively known as seed capital. Often times seed capital will come in the form of bootstrapping, and other times it may come from family or close friends. The advantage of using your own money or borrowing from someone close to you is that you won’t incur interest.

Crowdfunding

The internet age has introduced many new ways for business owners to improve, including their access to funds. That’s right, the internet is useful for things other than likes and comments (not to take away from the strengths of social media marketing). Crowdfunding allows a person to gather a large quantity of small investments by simply signing up to a website such as GoFundMe and sharing a custom link via social media, email, or otherwise. Often times, people will be encouraged to invest in a crowdfunding campaign that offers a reward of some sort in return for the donation.

Venture Capital

Venture capital is harder to come by than crowdfunding, since venture capitalists will be much more careful when considering whether or not to invest in a startup business. Investors may offer an exchange of their funds, expertise, or some other resource in return for a portion of your business. While the size or scale of the investment may be impressive, just be sure to remember that giving equity in your business is also giving up a portion of your decision-making power.

Government Grants

There are lots of existing government grant programs for small businesses in a wide variety of industries. Those grants may come from the local municipality, from the state, or even from the federal level. It should be noted that government grants can have fairly strict requirements, including a business plan, a list of goals with estimated dates for completion, and so on.

Don’t think a startup business loan is the right funding solution for you?

Do you still have questions and want to speak with one of our representatives? We’re here to provide the answers! Don't hesitate to reach out for help.