Trusted Partners

All About Hotel Loans

Get a room!

Well, considering the numbers in the U.S. hotel industry, getting a room might be easier said than done. And that’s good news for hotel business owners. The industry is growing so make sure your hotel grows with it!

These U.S. hotel industry stats show just how much the industry’s growing:

- Since 2011, U.S. hotels have seen nearly constant year-to-year increases in monthly average RevPAR (revenue per available room) - reaching a record-high of nearly $100 in July 2019.

- RevPAR in the U.S. lodging industry is forecasted to increase by 1% between 2019 and 2020, continuing a 9-year trend of positive growth in the sector.

- Hotel revenues are forecasted to reach $205 billion in 2020

- As of 2018, the average daily rate (ADR) of the U.S. hotel industry reached roughly $130.

- The annual growth rate between 2015 and 2020 averaged out at 2.7% - a trend expected to continue for the near future

Those stats aside, it’s also worth noting how it’s becoming easier to get approved for hotel business loans - particularly for smaller hotel projects. Since small hotels are quicker to build, have lower costs, and are less risky projects overall, they’re more likely to be met with approval when applying for hotel financing.

In plain language: Business owners of smaller hotels are seeing good times when it comes to borrowing money.

Wondering what to use hotel business loans for and which is right for your business? Scroll down!

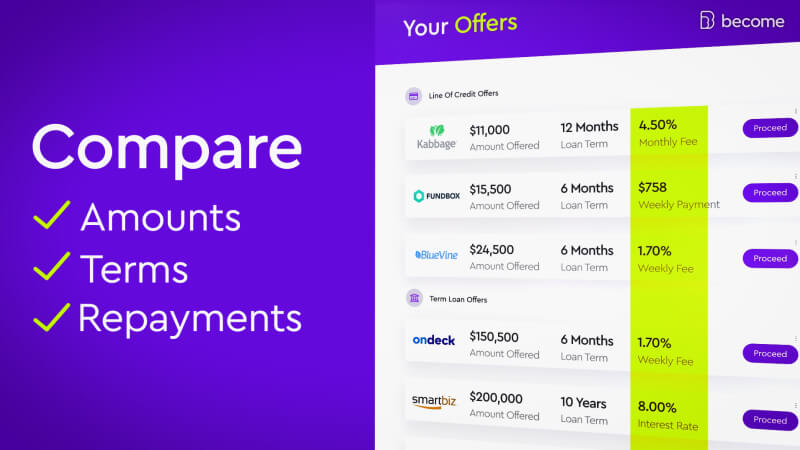

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

What Is Hotel Financing Used For?

On the whole, hotel financing is an absolute must for any serious hotelier. Why? We’re glad you asked!

First off, the hospitality industry sees drastic changes in business throughout the year - with summer generally being the peak and winter being the trough. Perhaps local tourist attractions that depend on warm weather are the main source of your business. Maybe you see huge boosts during a holiday season, only to be immediately followed by steep dives in revenue. Whatever the reason for fluctuations in cash flow is, hotel loans can be the solution you need to make it through slower months.

Secondly, hotels rely heavily on their utilities working properly. After all, if customers don’t have hot water or electricity, then you can kiss that reference goodbye! When you’re looking at dozens or even hundreds of rooms then, of course, it requires a lot of maintenance to keep things running as they should. Hotel financing in the form of a business line of credit could be very useful for those expenses related to maintenance.

Aside from serving to help businesses survive during the off-season and stay on top of maintenance needs, hotel business loans are useful for a wide variety of purposes including:

- Purchasing new property

- Financing construction of new hotels

- Paying for expansions on existing hotels

- Refurbishments or renovations

- Implementing a business disaster recovery plan

- And so on

How to fund a hotel

With so many different ways to use hotel loans, naturally, there are specific types of business loans that will fit better for different projects or goals. For example, if the aim is to build a new hotel, then hotel bridge loans can be the right solution. On the other hand, if it’s a new marketing campaign you want to roll out, then a low-interest asset-based loan could be a better fit for your needs.

Every business has a different financial profile and different financial needs. So, ultimately, you should consider your specific position carefully before applying for hotel loans. Keep reading for our full list of the best hotel financing options around.

The 8 best hotel financing options

Hotel loans for purchasing real estate

1. SBA 504 loans

What is it: An SBA 504 loan is designed to help small businesses with long-term, fixed-asset loans. To be more precise, SBA 504 loans help businesses that are aiming to purchase land, heavy machinery/equipment, or to finance large and expensive construction/renovation projects.

Who is it best for: Hotel business owners looking to purchase land or equipment, or to finance large construction and renovation projects.

Repayment term: Up to 30 years

How to qualify: Your tangible assets must not exceed $15 million and you must have earned less than $5 million in net income over the past two years. There’s also a down payment in the form of equity (10-20%).

2. Commercial real estate loans

What is it: A form of business financing that, similarly to equipment or vehicle loans, uses the very property that you’re purchasing with the funds as the collateral to secure the loan itself.

Who is it best for: Business owners that are looking to purchase or renovate a piece of property - whether it be an existing building or a plot of land.

Repayment term: Depends on the specific type of commercial real estate loan you obtain, but can go up to 25 years (SBA loans).

How to qualify: Qualifying criteria for commercial real estate loans will vary from lender to lender, and from one particular loan type to the next. To put it broadly, lenders want to see that your hotel business has a healthy and stable financial record. They’ll do that by assessing your business’s financial history as well as financial forecasts.

Hotel loans for renovations

3. Unsecured business loans

What is it: An unsecured business loan means a loan with no collateral (collateral being an asset that you own such as a house, vehicle, your savings etc.). This means that the lender takes the brunt of the risk.

Who is it best for: Businesses that lack the collateral required for a secured loan or asset-based loan.

Repayment term: Generally range from 1 year to 5 years, but can be longer.

How to qualify: To qualify for unsecured business loans, your business must have a minimum credit score of 350, at least 3-6 months in operating history, and a minimum monthly turnover of $3,000-$10,000.

4. Business lines of credit

What is it: A business line of credit is a type of business funding that can be used on an as-needed basis up to a specified credit limit. A line of credit offers business owners a flexible financing solution that (unlike term loans) doesn’t place them under any pressure to use the funds that are available.

Who is it best for: Pretty much every business, as there’s no harm in having a financial safety-net in place.

Repayment term: Depends on the lender; it can be 6, 12, or 18 months.

How to qualify: Qualifying for business lines of credit requires having an operating history of at least 1 year, having online banking, earning a minimum monthly revenue of $4,200 for past 3 months, and have a minimum credit score of 300 (FICO).

Hotel loans for acquisitions

5. SBA 7(a) loans

What is it: A term loan that small businesses can use for a wide variety of business-related purposes including expansion, renovation, equipment purchases, working capital, refinancing, etc.

Who is it best for: Hotel business owners that anticipate having many different expenses in the acquisition process.

Repayment term: As with other SBA loans, up to 30 years.

How to qualify: Your business must be for-profit, not exceed the SBA size restrictions, and show good credit history as well as proof of your ability to repay the loan. Your business must also be on the SBA’s list of acceptable industries.

6. Asset-based business loans

What is it: An asset-based loan (ABL) is a type of business financing that carries collateral in the form of assets. Assets serve as a form of security that ‘backs-up’ the loan, making it easier to qualify if a business’s financial profile is weak in other regards (low monthly revenue, poor credit score, etc.).

Who is it best for: Businesses that are unable to demonstrate that their current cash flow will be sufficient to cover the cost of other types of business loans.

Repayment term: It can vary from a few months to a few years depending on the type of loan.

How to qualify: Your business must have valuable assets that can be used as collateral, are not pledged as collateral for other loans, and are not at risk due to existing financial issues.

Hotel loans for other situations

7. Invoice factoring

What is it: A type of business funding where unpaid invoices are sold to a lending institution that then collects the overdue payments on behalf of the business.

Who is it best for: Hotel business owners that are looking for a way to deal with non-paying customers.

Repayment term: Depends on the lender, but generally 6 or 12 months.

How to qualify: Your hotel must have an operating history of at least 6 months, a minimum credit score of 530 (FICO).

8. Business equipment loans

What is it: A specific type of business funding intended to assist in covering the costs of buying or leasing machines or tools used for professional purposes.

Who is it best for: Business owners that depend heavily on having properly functioning equipment in order to earn revenue.

Repayment term: It can range from as low as 3 months up to 5 years.

How to qualify: There’s no one-size-fits all list of criteria to qualify for business equipment loans. You might have a low credit score but have a high monthly revenue. The bottom line is, lenders will want to feel confident in your business’s ability to make repayments on time and in full.

Which loan type is right for me?

If you’re reading this and thinking, ‘well many of these options seem relevant and I’m still unsure which funding option is best for me and my business’ - then fear not! By using Become’s Marketplace, you’ll be able to see all the funding options you can qualify for and the actual loan offers from multiple lenders. Once you have all your options in front of you, you can speak with one of Become’s dedicated funding experts to help you figure out which is best for your needs.

How to qualify for hotel financing

The process of qualifying for hotel financing isn’t much different from how to become eligible for business loans in general.

The general idea is that lenders will want to do all that they can to reduce the amount of risk they take on when providing hotel loans.

There are many factors that play into the lender’s risk assessment, including your business bank transaction history, existing loan balances, monthly revenue, and so on.

Lenders may look at the following factors specifically when considering loan applications from businesses in the hotel industry:

1. Total available rooms

This metric represents the total number of available rooms in your hotel(s) multiplied by the number of days in the period being reported. For example, if there are 400 rooms available and 30 days in the reported period, then the total available rooms would equal 12,000. This not only paints a clearer picture of monthly capacity, but also to keep track of the number of out-of-service rooms and the impact they have on other metrics such as RevPAR.

2. Average daily rate (ADR)

This metric measures the average price paid for a room on any day within a reported period. It’s a particularly helpful measurement to have on hand when preparing pricing strategies and matching them with seasonal fluctuations in demand for rooms.

3. Revenue per available room (RevPAR)

This metric provides insight into the average amount of revenue that’s generated by a single available room on any given day within a reported period. Raising RevPAR requires either increasing the ADR or increasing the average occupancy rate.

4. Average occupancy rate

This metric is fairly easy - it’s the average number of rooms that are paid-for and occupied, divided by the total available rooms, within a reported period. The impact that average occupancy rate will have on a hotel’s business will ultimately depend on the ADR; if ADR is cut in order to raise occupancy, it must be done carefully otherwise RevPAR could actually drop instead of jump.

5. GOP PAR

As opposed to RevPAR which shows the revenue generated by an available room, the GOP PAR measures the total gross profits from all revenue streams divided by the number of available rooms. That gives a broader picture of how the business is performing on all fronts (not just revenue generated by rooms themselves) in relation to the number of available rooms.

While each of these factors in a hotel’s financial profile are important to take into consideration, one of the biggest is if your business has existing loans that need to be paid off.

Refinancing a hotel loan

In an effort to scale up your business, there’s a good chance that you may have taken out forms of hotel financing that you’d now like to refinance. A lot can change in a business over a relatively short period of time, including your ability to qualify for better types of business loans.

Refinancing a business loan for hotels isn’t quite as complicated as it may sound at first. Plus, the end result will ideally save you lots of cash, time, and energy that you can reinvest into your business to help it grow and generate more money. If you’re able to qualify for better financing options now than you were previously, take advantage of it and refinance your hotel loans!

Bottom line

With so many different hotel business loans fit for such a variety of purposes and business profiles, finding the right hotel financing option for you could get tricky. By using Become’s online business lending marketplace, you’ll have a fast and easy way to match with the optimal funding solution for your needs.