Trusted Partners

What are Retail Business Loans?

Retail business loans are, as the term may suggest, types of financing solutions meant for retail businesses. Retail store financing can be used for essentially any purpose related to maintaining or improving a retail business. There is a wide variety of types of retail loans available, as well as lots of different ways to use a loan for a retail shop. Additionally, retail business loans are very flexible with regards to which kinds of stores can qualify.

With the average monthly income for small-to-medium sized retailers at just over $22,000 and the average of roughly 480 transactions per month, many business owners will find themselves in need of retail store financing. We’ve answered “what is a retail loan”, but you may still be wondering what exactly you can use retail store financing for.

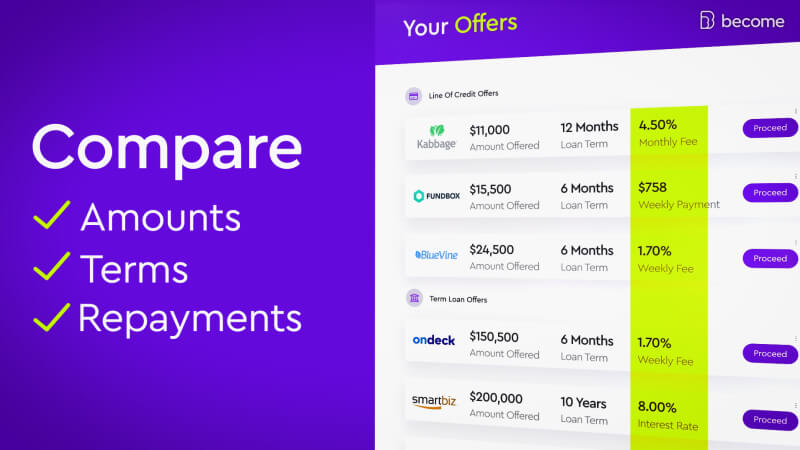

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

How Can I Use a Loan for Retail Businesses?

The uses for retail business loans are virtually endless and are determined largely by what kind of retail business is being financed. In order to provide suggested ways to use a loan for a retail business, we must first consider what type of retail business it is. Are you running a brick-and-mortar retail store or an eCommerce business? What exactly you're selling. Is it clothing? Alcohol? Electronics? Pet supplies? Books? The list goes on - and the number of ways to use retail business loans is even larger than the number of types of retail stores.

Below are a handful of uses for retail finance for small businesses:

- Stocking up on inventory

- Hiring employees

- Purchasing equipment (cash registers, security cameras, etc.)

- Store fixtures (shelves, display cases, etc.)

- Buying or renting a brick-and-mortar location

- Marketing (social media marketing or traditional ads)

- Repairs or renovations

- Legal and accounting services

- Recovering after a disaster

- Insurance costs

- Utilities (electricity, water, gas, etc.)

The possible uses for retail business loans will ultimately boil down to what the business is selling, how big or small it is, what the long-term and short-term goals are, and much more. So, before deciding which type of retail loan is best for your business, it’s important to first carefully consider your intended purpose for taking out retail store financing. Why? Because certain types of retail loans are better for certain reasons.

Types of Retail Loans

Here we’ve gathered together a handful of the best types of retail loans that can help in four different situations. The qualifications listed beneath each of the retail loan types are the minimum values for those criteria from across all of our lending partners.

Best Retail Loans for Business Expansion: SBA 7(a) Loans

Whether you’re looking to open another branch, build on your existing retail store, or diversify the products you sell, SBA loans for retail businesses are among the most useful types of retail funding. It is important to note, though, that SBA loans aren’t technically loans. Rather, they’re a guarantee of up to 85% that the government will provide to a lender in order that small businesses have improved odds of approval.

Qualifications:

- Minimum time in business: 3 months

- Minimum monthly revenue: $5,000

- Minimum credit score: 500 (FICO)

- Loan term: Up to 10 years

Best SBA 7(a) Loan Providers:

Best Retail Business Loan for Purchasing Inventory: Unsecured Business Loans

Unsecured business loans are an ideal financing solution for retail stores to stock up on inventory and keep the shelves full. Since unsecured business loans require no form of collateral, they’re perfect for small retail business owners who either don’t have valuable assets or prefer not to use them as security. Although the qualifications are a bit stricter, if you do get approved for an unsecured business loan you’ll likely have an easier time obtaining other forms of retail store financing.

Qualifications:

- Minimum time in business: 6 months

- Minimum monthly revenue: $10,000

- Minimum credit score: 450 (FICO)

- Interest rates: Start at 7.5%

Best Retail Business Loans for Unexpected Expenses: Business Line of Credit

When deciding on retail finance for small

businesses, the usual process is to consider the purpose of taking the loan. But what about those costs which arise unpredictably? A business line of credit works very similarly to a credit card, where the funds are there to be used on an as-needed basis. There’s no penalty for not using the available funds, and usually a business line of credit is revolving, which means the money can be borrowed and repaid continuously. A business line of credit is the back-up financing that any and every business should have at hand.

Qualifications:

- Minimum time in business: 3 months

- Minimum monthly revenue: $4,200

- Minimum credit score: 450 (FICO)

- Repayments: Monthly, typically automated

Best Line of Credit Providers:

Best Retail Business Loans for Fast Funding: Merchant Cash Advance

If your retail store is in a financial jam and you need quick access to funds, a merchant cash advance may be a useful solution. It should be noted, though, that an MCA is typically recommended as a fallback plan if all other funding solutions are out of your reach. The reason merchant cash advances are generally treated as a last-case-scenario when considering retail business loans is that the interest rates are so high. That said, they are pretty easy to attain even if you have poor credit or don’t have valuable assets to use as collateral.

Qualifications:

- Minimum time in business: 2 months

- Minimum monthly revenue: $4,500

- Minimum credit score: 300 (FICO)

- Financing speed: As short as 2 hours

Best Merchant Cash Advance Providers:

What Are the Required Qualifications for a Retail Business Loan?

The question of what it takes to qualify for retail store financing really comes down to what types of retail loans are relevant to your store, your intended use, and your financial requirements.

Since all of those details will vary so greatly from one business to the next, the safest answer to give is that, ultimately, the biggest determining factor of whether or not you’ll qualify for retail finance for a small business is if you own a retail store or not.

If you do own a retail store, Become can help you significantly improve your chances of obtaining financing for your retail business. With LendingScore™ technology, small business owners get unique, in-depth insights into what it'll take to improve their fundability. Apart from getting a score between 0 and 100 which indicates your likelihood of getting funded, you'll also be given tailored guidance on exactly which factors you need to work on in order to get approved for funding. Become makes all of those benefits available without any associated cost - plus it doesn't impact the business owner's credit score.

How to Improve Your Chances of Getting a Retail Business Loan

Applying for a loan for your retail shop through Become will give you unique advantages that you’ll be hard-pressed to find through any other online business lending platform. Our cutting edge applications of financial technology are revolutionizing the business lending process.

With the proprietary LendingScore™ technology, a business’s financial profile is analyzed from top-to-bottom by taking into account a broad spectrum of factors that impact approval odds. That assessment then produces a LendingScore™ out of 100, which serves to indicate to the business owner how good their funding chances are. Additionally, through the LendingScore™ Dashboard, Become provides tailored guidance for businesses on how to improve the specific financial factors that are preventing them from qualifying for more and better retail business loans.

It doesn’t end there. The advanced algorithms in the Matchscore™ technology then pair your retail business to the loan providers that best fit your business’s requirements with optimal precision. No more filling out tons of separate forms - by applying through Become you’ll have the benefit of a lending network comprised of dozens of the top lending partners from across the USA and Australia.

How to Apply for a Retail Business Loan

Step-by-step guide for applying for retail business loans:

- Choose your desired loan amount and select ‘Get Loan Offer’

- Fill in the requested information (including time in the industry, revenue, business, etc.)

- Submit your business’s checking account information for analysis

- Wait for offers. You can also review your status by clicking ‘Access Your Loan Application’

- Review offers and select your preferred lender

- Receive the funds to your business checking account

- Review your tailored LendingScore™ dashboard to improve your funding options

- Improve your rates - if your LendingScore™ is insufficient, follow the personalized plan (8-12 weeks to unlock funding)

(your credit score won't be affected!)

Don’t think a retail business loan is the right financing option for you?

If you still have any questions and would like to speak with one of our representatives, please feel free to reach out to us!