-

How Asset Based Loan Financing Works

Loading...How much do you need?

Select your loan amount or pick an amount below:

$5,000-$1,000,000Please select the amount you needCompare Offers It’s free & won’t affect your credit score$10,000$25,000$50,000$75,000$100,000$250,000Become is not a lender. Loan approval & terms are not guaranteed and are set solely by our lending partners.

-

What do you need the money for?

-

When do you need the money?

-

What’s most important for you?

-

You Are Not Alone

Percentages are based on self-reported data from Become users -

When did you start your business?

An estimate is perfectly fine.

-

Monthly revenue?

(average over past 3 months) -

What’s your estimated credit score?

Don't worry, checking your options won't affect your score.

-

You're in trusted hands

Join thousands of businesses who

trust us with their financing needs4.8/5 on Trustpilot (612 reviews)$410M+ funded through Become28,000+ businesses matchedOperating since 2018It was an easy experience. The person assigned to my account was so helpful. She explained everything to me so that all my questions were answered and I was comfortable with my loan.

Nina Galvin, Beauty & Business AcademyFinalizing your funding profile...Stats current as of 03/2026

Individual results vary -

Summary of Your Funding Profile

Business loan options are provided for informational purposes only. Become is not a lender. Loan approval, terms, and rates are determined solely by our lending partners and are not guaranteed. -

Important: We're here to help businesses registered in the USA, Australia, and New Zealand. If your business is registered in one of these countries, you’re good to go! Otherwise, we’re sorry, but we won’t be able to provide our service.

-

See Your Matched Offers

By clicking "Unlock My Offers", I agree to the E-Sign Consent, Terms of Use, Credit Authorization Agreement (“CAA”) and Privacy Policy. I authorize Become CO LTD to share my information with its Lending Partners named in the CAA and give my prior express written consent, under the Telephone Consumer Protection Act, for Become CO LTD and those Partners to contact me by phone, text (including autodialed or prerecorded voice), and email for marketing purposes. Message & data rates may apply. Consent is optional — proceed without calls/texts. Revocable at any time by clicking "unsubscribe" or emailing support@become.co. I also agree to the Spinwheel End User Agreement and provide “written instructions” to Spinwheel Solutions, Inc., authorizing it to obtain my credit profile from any consumer reporting agency. Spinwheel and/or certain Lending Partners may perform a soft credit inquiry; this will not affect your credit score. -

Verify It's You

We’ve sent a 6-digit code to:

usually arrives within 30 secondsVerifying…Code sent! Please check your phone.Didn't get the code?

Resend SMS in sHaving issues with the code? Try a different verification methodWe take your privacy seriously.

Phone number verification is a critical step in confirming your identity.Update Your Mobile Phone Number

-

Sorry for the detour! A few more quick questions to finish verifying you

What’s your home ZIP Code?

This is for identification purposes

Please wait...Please wait... -

Your Social Security number

Please wait...This could take about a minute.Provide accurate info for the most suitable options

Your data is safe with us

protected by advanced encryption

-

Please answer the following questions

Secure Identity Verification

Please wait...This could take about a minute. -

Confirming Identity

Please review and confirm to proceed with your application

Trusted Partners

-

4.6 · 785 reviews

-

4.8 · 38 reviews

-

4.7 · 1,111 reviews

-

4.6 · 21,744 reviews

-

4.9 · 1,399 reviews

-

4.6 · 15,585 reviews

-

4.4 · 10 reviews

-

4.4 · 11 reviews

-

4.5 · 16,279 reviews

-

4.7 · 1,111 reviews

-

4.5 · 16,279 reviews

Asset-Based Loans for your Business

What is Asset Based Lending?

An asset-based loan is a business loan which carries collateral in the form of assets, such as business equipment, inventory, and assets from balance sheets. When a business cannot ensure that its cash flow can cover the loan, the lender can approve the loan based on the overall value of the business's assets.

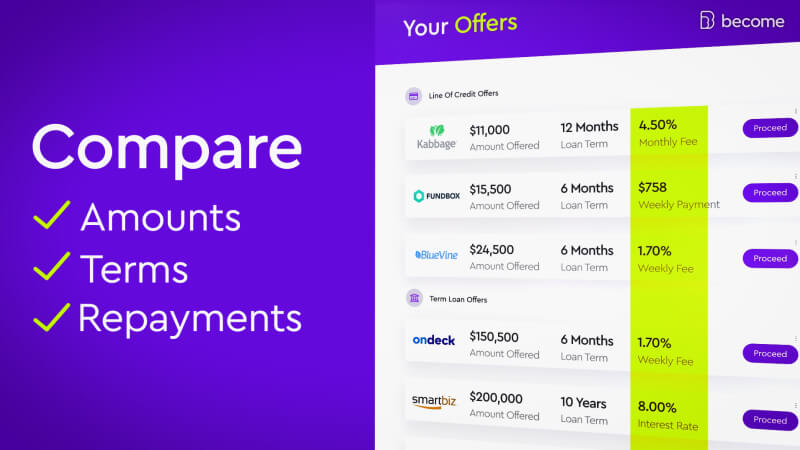

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

Important To Know

Asset-based loan interest rates are low

When comparing the rate of interest to alternative loans, in particular, unsecured business loans, the interest rates on asset-based loans is considerably lower and this alone is always a major plus for business owners seeking funding for small businesses. The primary reason for the low rates is because the business's assets can be used as collateral in the event that repayment cannot be made.

New equipment can be purchased

Asset-based loans enable businesses to acquire new and improved equipment, and of the highest quality. New equipment significantly boosts productivity levels and increases output due to fewer repairs required and lower maintenance costs. This saves ample amounts of business capital for everyday business operations.

Asset-based loans have tax benefits

Though capital allowances, businesses which have taken out asset-based loans are eligible for tax benefits in certain cases. These benefits come in the form of financial deductions corporation tax bills. A major advantage is that these allowances are available on a multitude of business inventory and equipment.

Customer Testimonials

After over 10 years in business, we've helped tens of thousands of companies secure funding.

Here's what some of our customers have to say.

-

I really love LendingScore™, which helped me to focus on the right things to increase my business credit. The process was easy and they checked in regularly to make sure that I was aware of lending options available.Shannon Deamer from Smyrna, GA

-

They were so helpful and explained everything to me so that all my questions were answered and I was comfortable with my loan.Nina Galvin from Cranston, RI

-

Become has been extremely helpful to our growing business! We had lenders compete for our business and close a loan that works for us!Antonio L. from Tampa, FL

-

The process was fast and very easy. I didn't encounter any problems from the beginning of the application to when I was funded.Nathan Pease from Hamilton, MO

-

I had a great experience getting a loan with Become. The staff was very responsive and guided me throughout the whole process. I highly recommend working with Become!!Jimmy Potters from Fairfax, VA

-

Just wow. Had work with some companies before and had taken longer for a way smaller amount. Got my line of credit in about 15 minutes and receive the money less than 48 hours after applying.Veronica Lamas from Lawndale, CA

-

They kept trying and trying for me. I know I wasn’t their only client but they made me feel like I was. I really thought they had my back every day.Website was good too. No complaints!Ryan Methner from Mount Pleasant, MI

-

I was connected to a lender, and everything was done with the click of a button.Frank Williams from Greenville, MS

-

It was a completely smooth process from the beginning to the end. I signed up and was funded within the day. Couldn't ask for anything more.Mason K Hanger from West Columbia, SC

-

This is the best! 5-Star Service. I will recommend to small business everywhere.Fort Myers Beach from Fort Myers, FL

Why Businesses Love Us

How It Works

Ready to

become more?

Apply now

Great News!

You are likely to qualify for a business loan