Trusted Partners

Asset-Based Loans for your Business

What is Asset Based Lending?

An asset-based loan is a business loan which carries collateral in the form of assets, such as business equipment, inventory, and assets from balance sheets. When a business cannot ensure that its cash flow can cover the loan, the lender can approve the loan based on the overall value of the business's assets.

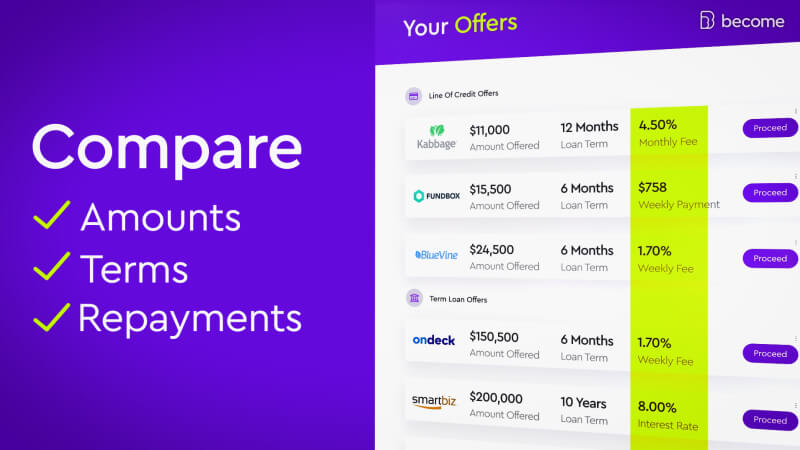

Compare funding offers!

Discover all of your funding offers and secure the best loan for your business. Compare. Choose. Get funded!

Important To Know

Asset-based loan interest rates are low

When comparing the rate of interest to alternative loans, in particular, unsecured business loans, the interest rates on asset-based loans is considerably lower and this alone is always a major plus for business owners seeking funding for small businesses. The primary reason for the low rates is because the business's assets can be used as collateral in the event that repayment cannot be made.

New equipment can be purchased

Asset-based loans enable businesses to acquire new and improved equipment, and of the highest quality. New equipment significantly boosts productivity levels and increases output due to fewer repairs required and lower maintenance costs. This saves ample amounts of business capital for everyday business operations.

Asset-based loans have tax benefits

Though capital allowances, businesses which have taken out asset-based loans are eligible for tax benefits in certain cases. These benefits come in the form of financial deductions corporation tax bills. A major advantage is that these allowances are available on a multitude of business inventory and equipment.